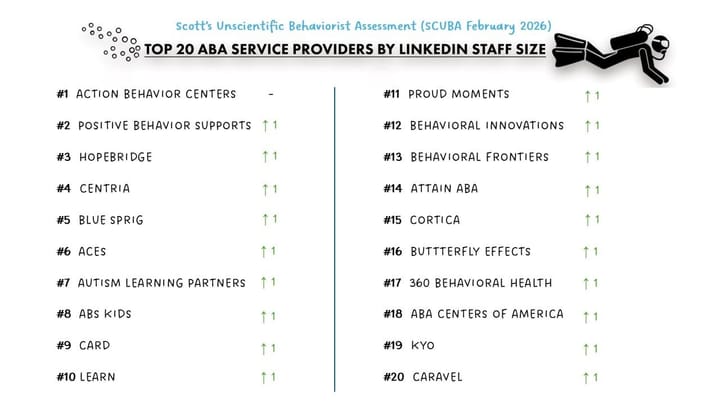

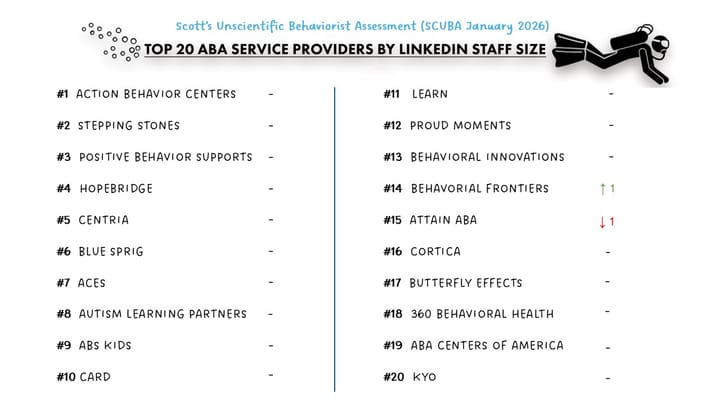

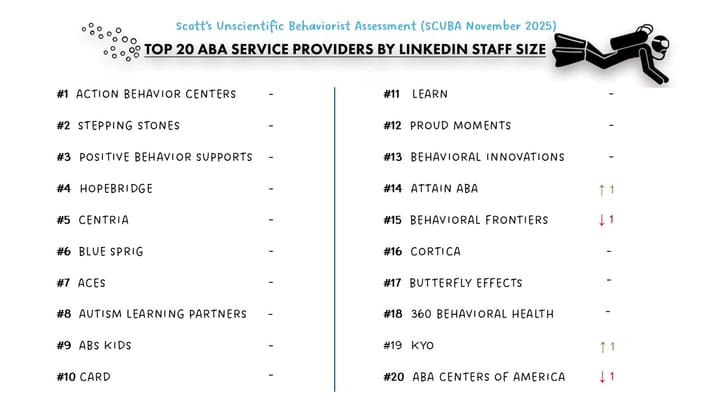

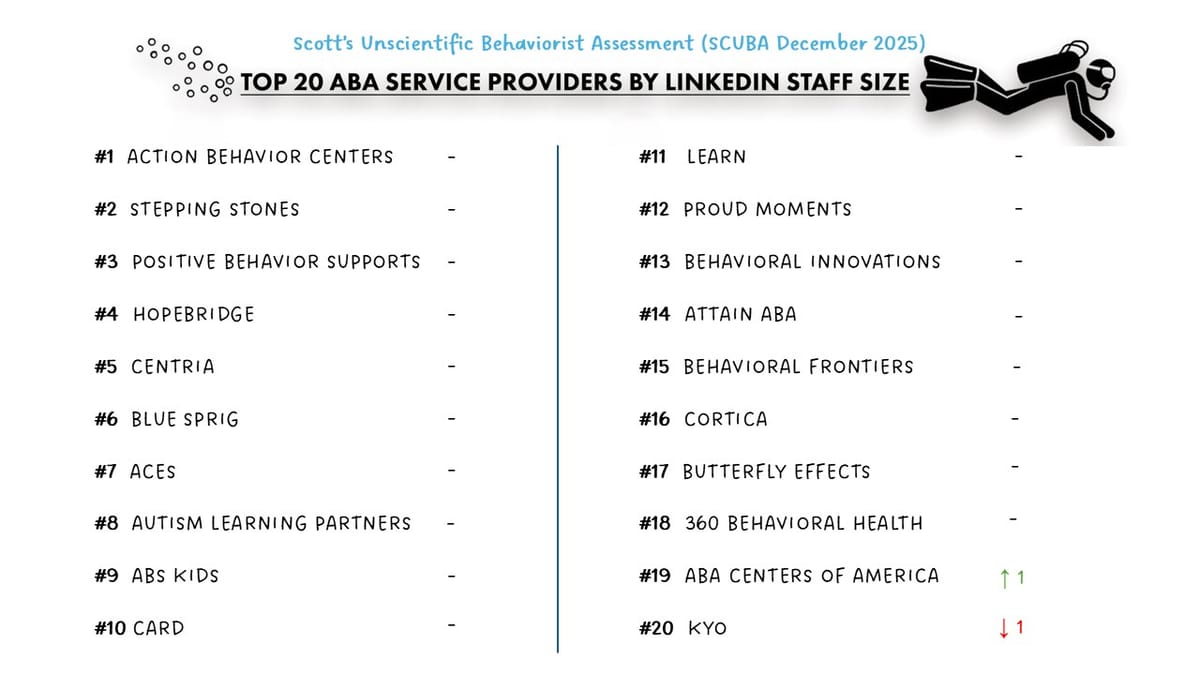

Provider SCUBA December 2025 Snapshot

⚠️ Methodology Reminder

SCUBA = Scott’s Completely Unscientific Behaviorist Assessment — a deliberately imperfect, directional look at staffing momentum across ABA providers.

This is not a census. LinkedIn undercounts direct-care staff, headcount can lag payroll, and Glassdoor reflects sentiment, not outcomes. But across 130+ organizations tracked consistently over time, these imperfect signals still surface meaningful structural patterns in the ABA market.

📊 December 2025: Culture as a Differentiator Within Scale

With relatively little headline news from December, the Provider SCUBA leads with a structural question:

Among the largest ABA providers, does culture merely survive scale — or does it meaningfully differentiate growth outcomes?

Using two imperfect but directional proxies

— LinkedIn headcount growth (Jan → Dec 2025) and Glassdoor ratings (Dec 2025 snapshot) — the data suggests a more layered answer than a simple “scale hurts culture” narrative.

The Top 20: Growth Without a Simple Sentiment Pattern

Across the Top 20 largest ABA providers, LinkedIn staff counts grew by ~21% over the course of 2025.

At the cohort level:

- employee sentiment clusters in the mid-3s

- headcount growth shows no strong linear correlation with Glassdoor ratings

- scale alone does not predict cultural outcomes

This supports a familiar conclusion:

At large scale, growth and sentiment often decouple.

But stopping there misses the most interesting signal.

The Top 5: Culture as a Real Separator

When isolating the five largest providers, a clearer pattern emerges:

- All five post Glassdoor ratings above the Top-20 average

- All five also delivered above-average headcount growth within the Top-20 cohort

- None relied on flat or declining sentiment to sustain expansion

This matters because it suggests something more specific than “culture doesn’t matter at scale.”

A more accurate takeaway is:

Among the largest providers, better-than-average culture appears to be associated with better-than-average growth — even when scale complexity is already present.

This does not imply that culture alone drives growth. But it does indicate that, at the very top end of the market, execution quality and internal alignment can meaningfully separate leaders from peers operating under similar external constraints.

Outside the Top 20: The Pattern Strengthens

The signal becomes even clearer just below the largest tier.

A cohort of the fastest-growing mid-tier providers including SOAR, Yellow Bus, Achievements ABA, Positive Development, Golden Steps, Brighter Strides, Behavioral Framework and Akoya shows:

- materially higher average Glassdoor ratings (low-to-mid 4s)

- sustained growth momentum throughout 2025

- fewer signs of cultural dilution during expansion

Compared to the Top-20 baseline, the fast-growth cohort’s average Glassdoor rating is roughly 0.7–0.8 points higher — a meaningful gap for an aggregate measure.

This reinforces a consistent SCUBA theme:

Culture appears to function as a growth accelerant until organizational complexity overtakes leadership proximity.

The Top 5 demonstrate that this accelerant does not disappear entirely at scale — but it becomes harder to maintain.

How to Read This (and How Not To)

This analysis does not claim that:

- Glassdoor ratings cause growth

- large providers with lower ratings are structurally disadvantaged

- culture alone explains market leadership

It does suggest that:

- culture becomes a competitive differentiator once scale thresholds are crossed

- the best large providers find ways to preserve alignment longer than peers

- the strongest cultural signals today live either at the very top or just below it

Why This Matters Heading Into 2026

2025 looks less like a single leaderboard and more like stratification:

- Top 5: scale plus execution discipline

- Next 15: scale with mixed cultural outcomes

- Fast-growth mid-tier: culture-led momentum

- Long tail: increasing divergence

The ABA market is not shrinking.

It is sorting — by scale, by execution quality, and by the ability to carry culture forward as organizations grow.

If you’re navigating these shifts — whether as a provider, platform, or investor — let’s connect. Interested in keeping pace with Tech, Ops and Data content? Subscribe here