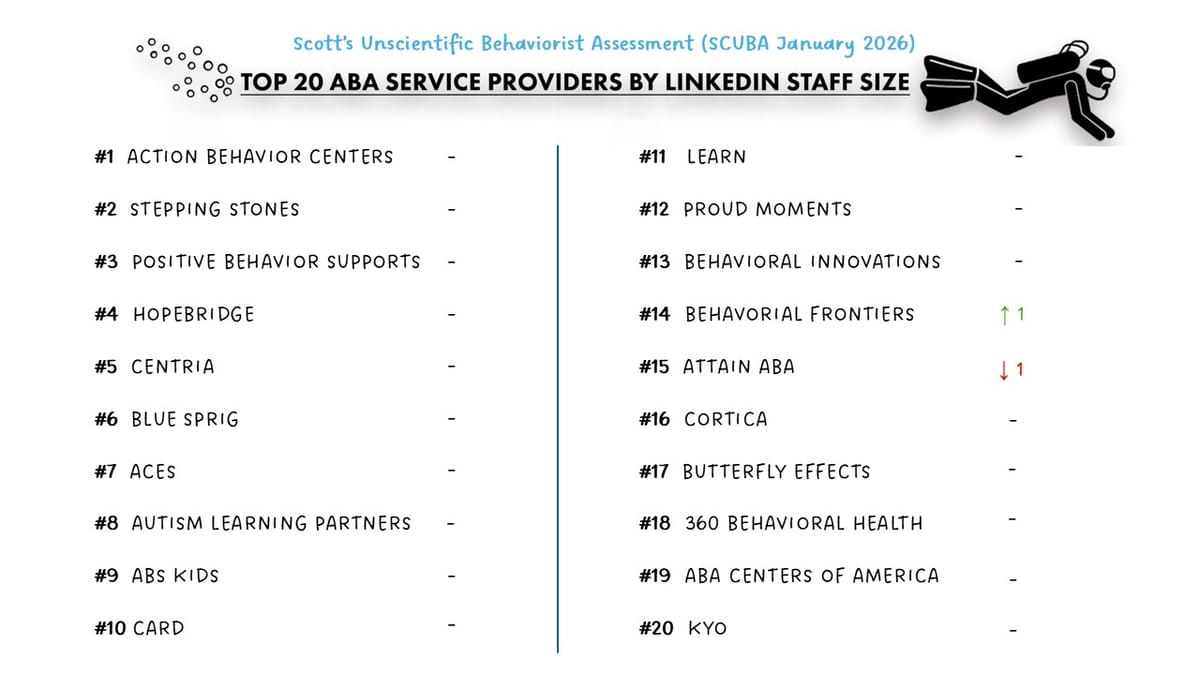

Provider SCUBA January 2026 Snapshot

Theme: Second-Order Effects Are Now the Primary Operating Risk

⚠️ Methodology Reminder

SCUBA = Scott’s Completely Unscientific Behaviorist Assessment — a deliberately imperfect, directional look at staffing momentum across ABA providers.

This is not a census. LinkedIn undercounts direct-care staff, headcount lags payroll, and public job postings reflect intent more than execution. But across 130+ organizations tracked consistently over time, these signals continue to surface meaningful structural patterns in the ABA market.

What “Second-Order Effects” Mean (Briefly)

First-order effects are visible and immediate:

rate changes, funding rounds, acquisitions, policy announcements.

Second-order effects show up later — after those decisions hit real operations.

In January, the most important signals were not new headlines, but how providers are quietly adjusting service mix, staffing posture, and operating discipline in anticipation of downstream impact.

1. Policy & Payor Environment

Constraint Is Shifting from Rates to Mechanics

The dominant policy signal is not blunt rate action, but tighter control over how care is delivered.

Across markets, utilization governance is becoming more explicit:

- greater scrutiny on authorized hours, clinical documentation and service formats

- narrower definitions around supervision, coordination, and caregiver involvement

- rising administrative friction embedded in credentialing, reauth, and claims workflows

Second-order signal:

Access and margin erosion increasingly occur operationally — through workflow constraints and utilization mechanics — rather than visibly through rate cuts.

2. Scope Divergence: OT / ST / PT as a Second-Order Fault Line

One of the clearest second-order splits in the market right now is how providers are handling multidisciplinary services.

At smaller scale, multidisciplinary scope is still being used as a growth lever. Providers like KidsChoice are leaning into ABA alongside OT and speech to deepen referral relationships and expand site-level economics while organizational complexity remains manageable.

At larger scale, the strategy shifts.

Following its acquisition of Ally Pediatric Therapy, ACES is unwinding in-house OT, ST, and feeding services and replacing them with external care coordination — aligning with a deliberately ABA-centric operating model.

The divergence itself is the signal.

Second-order signal:

Multidisciplinary breadth differentiates early. As scale increases, unmanaged complexity compounds faster than revenue.

3. Anticipation as a Capability

Change Management Is Becoming a Separator

A small but growing set of providers are treating change as something to be modeled and sequenced, not reacted to.

They are planning for downstream effects on:

- staffing and scheduling

- family experience

- data integrity

- operational handoffs

Others absorb these effects later, when fixes are more expensive.

Second-order signal:

Anticipation preserves flexibility; reaction consumes it.

4. Ops, Tech, and Data Create Optionality

January included a steady stream of modest but telling activity:

- small provider tuck-ins

- selective growth capital

- quiet ownership transitions

These do not signal a reopening of the market.

They highlight that operational maturity is now the gating factor — not ambition or capital availability.

Second-order signal:

Disciplined ops, tech, and data do more than reduce risk. They create choice when peers are constrained to defense.

5. Capital Is Repricing the Care Unit

Growth capital continues to favor models that explicitly reduce utilization intensity while maintaining outcomes:

- BCBA-centric

- parent-mediated

- virtual-first

Efficiency is no longer framed as back-office optimization. It is being embedded directly into the care model.

Second-order signal:

Utilization control is becoming a prerequisite for scale, not a downstream improvement.

Hiring Signal — Selective, Not Re-Accelerating

Public job postings appear more restrained than peaks observed in mid-2025.

At the same time, overall headcount across the dataset continues to rise — suggesting:

- more targeted hiring

- tighter role definition

- fewer speculative postings

Second-order signal:

Hiring has not collapsed. It has become deliberate.

SCUBA Takeaways — January 2026

- Second-order effects now dominate first-order signals

- Operational mechanics, not rates, are the binding constraint

- Multidisciplinary scope helps early — and must be actively governed later

- Ops, tech, and data maturity create resilience and optionality

- Capital is underwriting execution risk, not growth narratives

The ABA market is not pausing.

It is sorting by who can anticipate what breaks next.