Provider SCUBA – June 2025 Update: The top 2 get even bigger

Welcome back to SCUBA — Scott’s Completely Unscientific Behaviorist Assessment — where I track directional trends in ABA provider hiring, growth, and strategy using publicly available data.

⚠️ Important Note on Methodology:

This data isn’t perfect. LinkedIn misses many direct care staff, and state counts come from provider websites, which aren't always current. But taken together, these signals help us understand momentum, not precision — and that’s often what matters most. I always welcome feedback or corrections.

👉 Want to read overviews of each of the top 20 ABA Providers?

🔗Click here

📈 June 2025 Snapshot – Stronger Growth, Fewer Openings

✔️ LinkedIn-reported staff counts grew 2.76% — the biggest gain since January

✔️ But job postings fell 23.9%, indicating that most summer staffing decisions appear to already be in motion

🚀 Standouts: Action and Stepping Stones Pull Ahead

- Action Behavior Centers continues to outpace the field — with staffing up nearly 11% since April. They’re now more than twice the size of the #3 provider.

- Stepping Stones is also pulling ahead, both in headcount and reach. It’s one of the few expanding into new states and is now 50% larger than the #3 provider.

- Most others posted steady gains.

- I also track the top 130 providers, where overall growth mirrored the Top 20. A few outliers stood out — SOAR and Yellow Bus each posted 10% month-over-month growth.

🗺️ State Growth? Still Sparse.

Stepping Stones, CARD, and Attain each added a state — but it’s not a trend. Most of the top 20 are focused on deepening existing markets, not entering new ones.

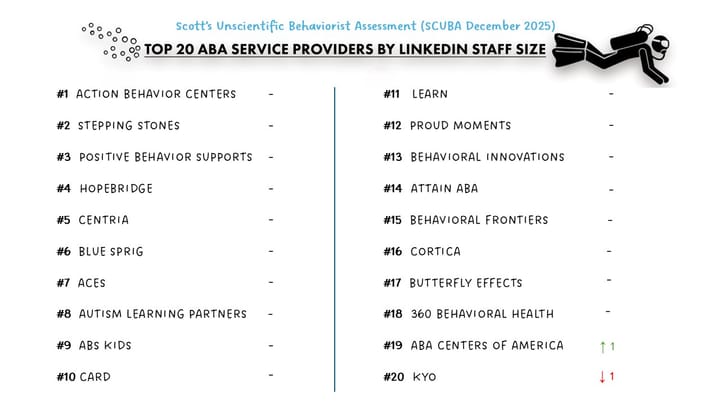

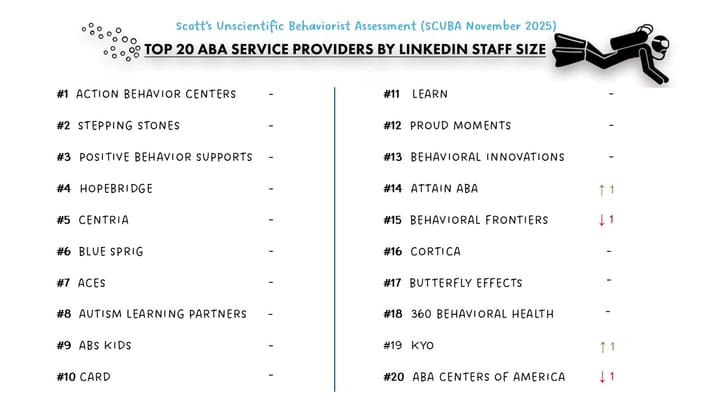

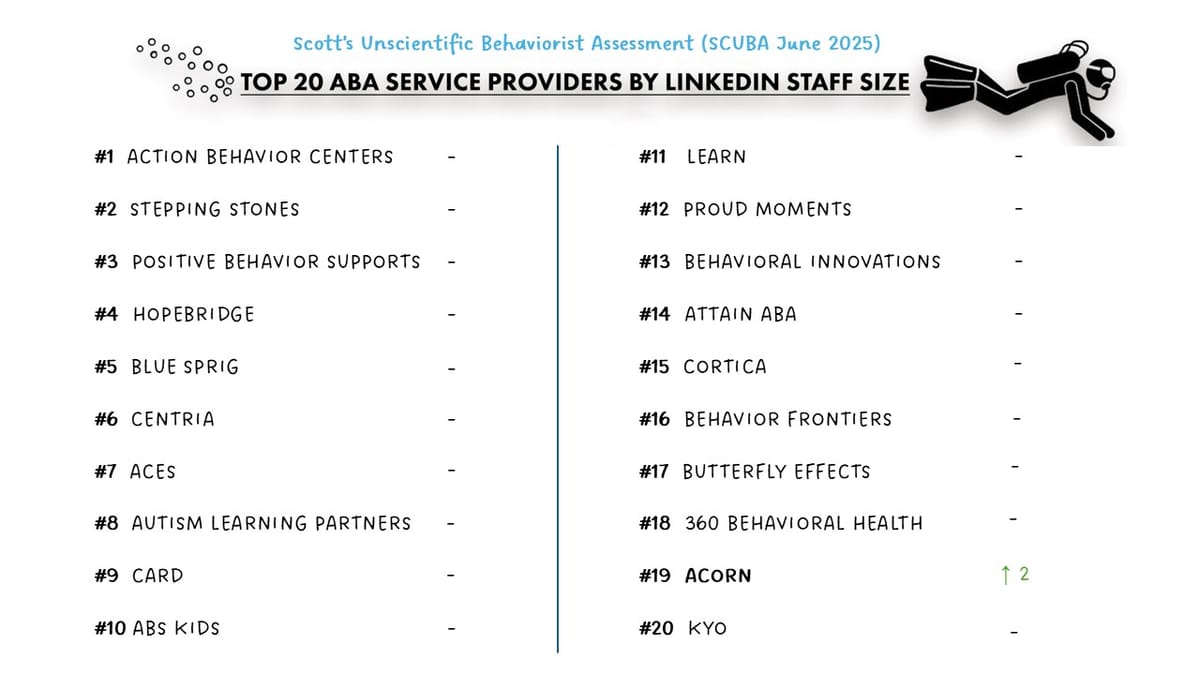

📊 Top 20 Rankings: Nearly Frozen

Only one change: CSD and Acorn swapped spots. Otherwise, the leaderboard hasn’t budged in months — a sign of either balance or stagnation.

💰 Reimbursement Caution Still Looms

Ongoing Medicaid audits and funding worries may be slowing hiring and expansion, pushing providers to focus more on efficiency than headcount.

📉 M&A Among Big Providers? Still Missing.

In an earlier post, I flagged the near-total absence of large-scale M&A at the top. That trend continues — and for investors who’ve held these platforms longer than expected, this could raise questions about liquidity, valuation, or the next exit play.