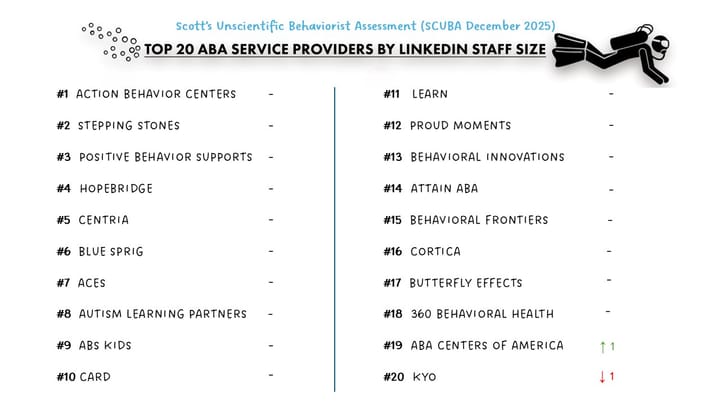

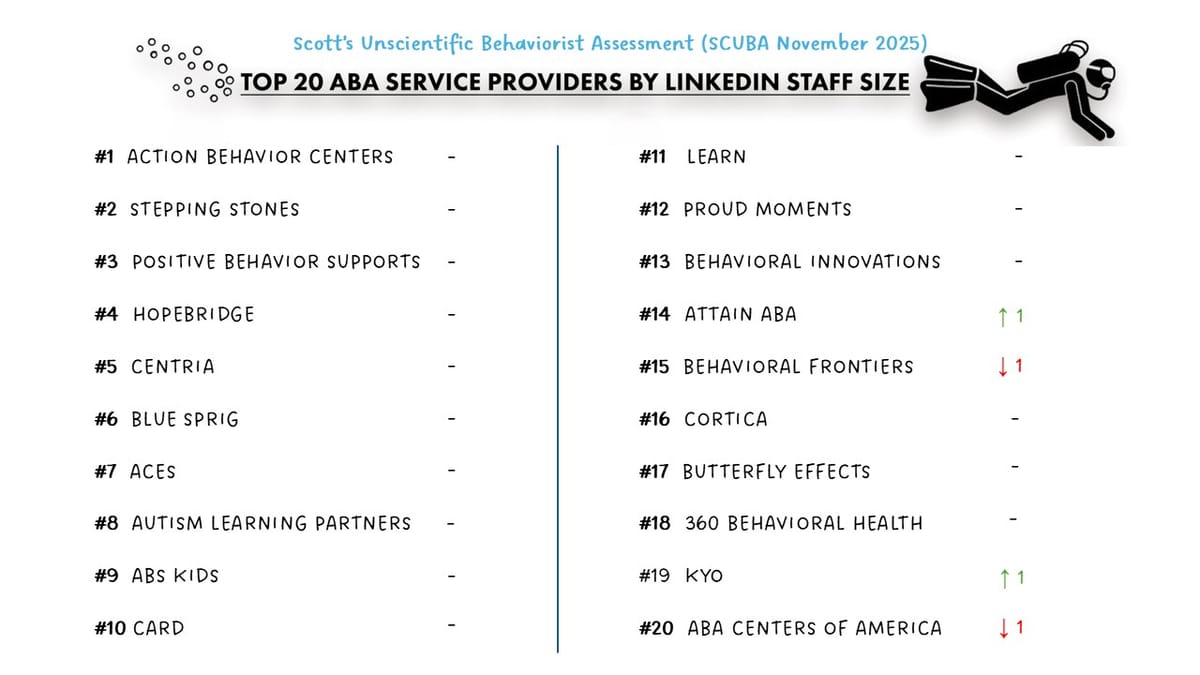

Provider SCUBA November 2025 Snapshot

⚠️ Methodology Reminder

SCUBA = Scott’s Completely Unscientific Behaviorist Assessment — a deliberately imperfect, directional look at staffing momentum across ABA providers.

This is not a census.

LinkedIn undercounts direct-care staff, headcount can lag payroll, and provider websites are rarely updated in real time. But across 130+ organizations, these unscientific signals still surface meaningful trends in hiring velocity, provider momentum, and market posture — often more useful than point-in-time precision.

📊 November Snapshot — Stability at the Top, Divergence Below

The Top 20 ABA providers collectively grew about 1.3% in November — steady, consistent with fall trends.

The Top 7, however, continue to separate from the field and now account for more than one-third of all staff across 130+ tracked providers.

Beneath that stability, a different story emerged: a cohort of mid-tier operators are driving a disproportionate share of total market growth.

🌬️ Medicaid Pressure Meets Managed Volume

Several states continued experimenting with mechanisms to manage ABA volume, not just reimbursement:

- Indiana floated lifetime caps and a temporary freeze on new clinic sites.

- Idaho removed ABA from BHMO oversight entirely, consolidating control under the state.

- Colorado is restructuring behavioral health oversight and reviewing ABA utilization pathways.

- North Carolina is deep into Medicaid redesign.

- Nebraska is revisiting medical-necessity and administrative rules for ABA.

The approaches vary, but the signal is consistent:

states want predictability and firmer utilization rules.

👉The constructive path forward is one rooted in clear criteria, early-intervention pathways, and transparent guardrails — not blunt caps that restrict access.

📌 Payors Tighten Definitions — A Mixed Signal

Major insurers, including Centene, continued refining definitions for supervision, care coordination, and caregiver engagement.

Done well, this increases consistency and outcome alignment.

Done poorly, it becomes denial infrastructure.

The long-term fix is the same: cleaner data, clearer expectations, and models that let payors manage through results, not paperwork.

🤝 Integrated Care Expands: Aetna x Cortica

Aetna’s new neurodiversity navigation program (launching January 2026) pairs digital coaching and care navigation with Cortica as a core clinical partner. (See earlier write-up on Cortica whole person care model.)

It’s notable because it suggests:

- Commercial insurers are now building autism infrastructure, not only cost controls.

- Integrated, cross-disciplinary models are gaining relevance even outside formal VBC.

- Navigation may become a preferred entry point for payors facing Medicaid pressure elsewhere.

It’s not a market shift yet — but it’s another upstream signal of where care models may be heading.

🌱 Mid-Tier Cohort Outpacing the Field

A distinct group of mid-sized operators outperformed both other mid-tier peers and several national incumbents.

This cohort includes:

- SOAR Autism Center

- Yellow Bus ABA (see Operator Spotlight)

- Achievements ABA (see Operator Spotlight)

- Positive Development (see DRBI investment)

- Golden Steps ABA

- Brighter Strides

- Behavioral Framework

- Akoya (see Operator Spotlight)

These organizations share several characteristics:

- multi-site footprints with disciplined regional strategy

- repeatable de novo execution

- steady, non-reactive hiring patterns

- enough scale to invest in operations, but not the legacy burden of the largest players

💰 A Green Shoot from This Cohort: SOAR’s $17M Raise

Behavioral Health Business reported that SOAR Autism Center secured $17M in new capital.

IMO, this doesn’t mark a broad reopening of the growth-equity market.

But it does underscore that:

- disciplined mid-tier operators can still attract investment, and

- this specific cohort is where much of the credible upside now lives.

Think of it as a green shoot, not an inflection point — but one worth noting.

📈 Breakout Operator of the Month: Behavioral Framework

Behavioral Framework posted one of the strongest month-over-month growth rates of any provider this year, up roughly 12%.

In an otherwise steady market, that kind of growth stands out — reinforcing that well-run regional operators can still scale quickly, even under Medicaid and labor pressure.

🚀 Hiring Patterns — Selective, Not Slowing

Most large incumbents kept hiring steady while reducing public job postings, suggesting more targeted recruiting rather than contraction.

- Action Behavior Centers grew another ~2.3% MoM.

- Several national groups held flat or showed modest gains.

The broader theme:

hiring hasn’t collapsed — it has become more deliberate, reflecting a shift toward efficiency and unit-level discipline.

💸 Capital Sentiment — Rate Drag, De Novo Bias

Investor sentiment in November remained cautious:

- interest rate uncertainty continues to slow underwriting

- Medicaid variability remains a dominant risk factor

- investors overwhelmingly favor de novo expansion over acquisitions

- only the most disciplined mid-market platforms are getting active attention

Capital is still in the space — but it’s moving slowly and selectively.

🌬️ A Note on Market Resilience

Despite heightened Medicaid scrutiny and cost-containment efforts, the field is not shrinking.

Headcount across the dataset continued to climb, and demand remains structurally underserved.

The market is not unwinding — it’s rebalancing, and operators with disciplined execution are the ones gaining share.

If you’re navigating these shifts — whether as a provider, platform, or investor — let’s connect. Interested in keeping pace with Tech, Ops and Data content? Subscribe here