SCUBA: July 2025 ABA Provider Snapshot

Scott’s Completely Unscientific Behaviorist Assessment

Where we track directional trends in ABA provider hiring, growth, and strategy — using only public signals, but with an insider’s lens.

⚠️ A Quick Reminder on Methodology

This isn’t gospel. LinkedIn undercounts front-line staff. State tallies are scraped from websites and may lag. But across 130+ providers, directional changes still offer insight into momentum — and sometimes, that’s more revealing than precision.

👉 Want a snapshot of the Top 20 ABA Providers?

🔗 Click here

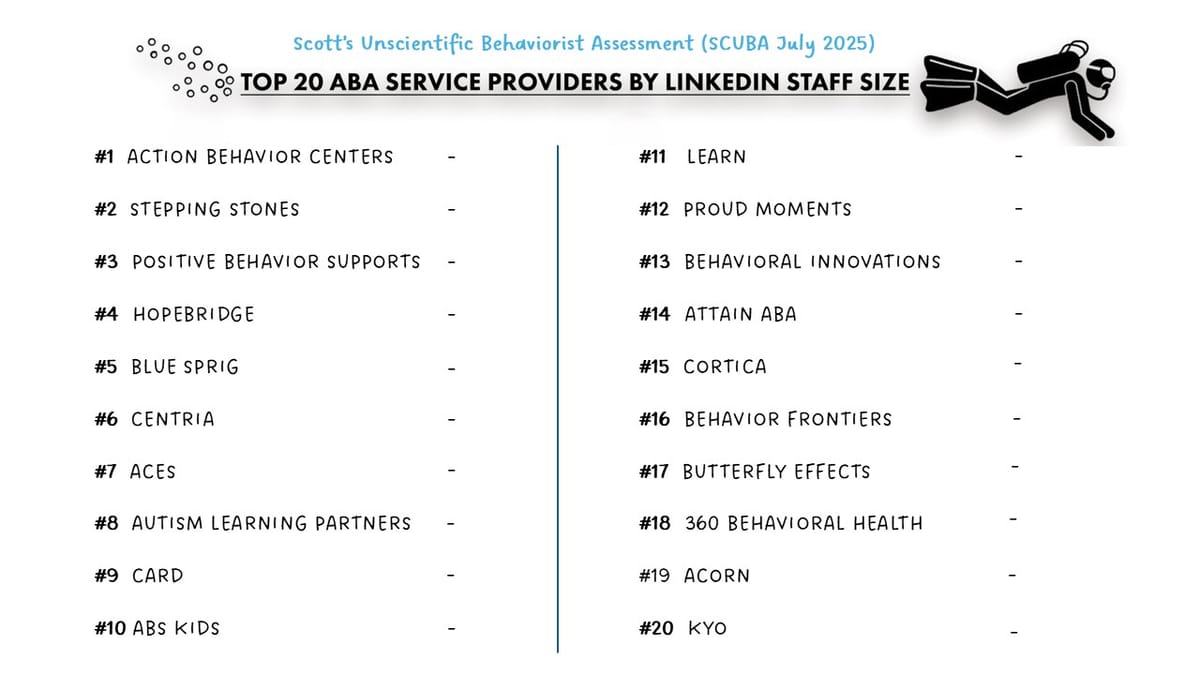

📈 July 2025 Snapshot – Slower Growth, but a Few Movers

✔️ LinkedIn-reported staff counts grew by just 1.3%, following a stronger June

✔️ Job postings remained flat, suggesting many summer staffing pushes are complete

🚀 Action and Stepping Stones Continue to Pull Away

Action Behavior Centers remains the clear #1 — now with over twice the headcount of the #3 provider. Their pace of growth is unmatched in the Top 20.

Stepping Stones Group was the only Top 20 provider to add a new state this month. Their continued headcount growth and geographic expansion set them apart — now roughly 50% larger than #3 as well.

Beyond those two, most major providers showed modest, steady gains, with no other state additions among the Top 20.

🌱 Mid-Tier Momentum: Achievements, SOAR, Yellow Bus

While the Top 20 mostly held steady, several mid-sized providers (ranked #21–#100) posted double-digit growth in July — all organic:

- ✅ Achievements ABA: +12%

- ✅ SOAR: +10.7%

- ✅ Yellow Bus ABA: +9%

These players may not dominate LinkedIn yet — but their trajectory suggests real operational momentum.

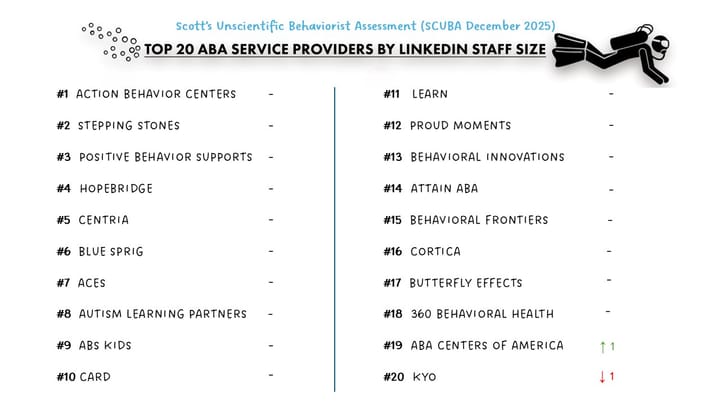

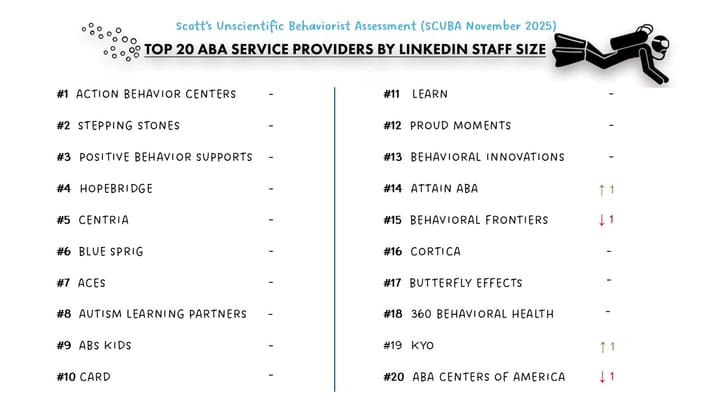

📊 Top 20 Rankings: Frozen in Place

For the first time this year, the Top 20 rankings remained completely unchanged.

Even CSD and Acorn, which previously swapped spots, held firm. The leaderboard’s stasis may reflect a mature, cautious market — or one holding its breath for bigger moves.

🏥 What About the Nonprofits?

You’ll notice that large nonprofit players like Easterseals, Bancroft, Merakey, Elwyn, and Vinfen are not included in SCUBA rankings.

That’s not because they’re irrelevant — far from it. Many of them operate ABA services at substantial scale. But their multi-service structure, blended funding models, and limited public staffing data make it hard to assess ABA-specific momentum.

Still, their role is critical — especially in underserved regions and with Medicaid-heavy populations. And as pressure mounts on private equity–backed providers, nonprofits may quietly become even more vital to sustaining access.

💰 Reimbursement Pressure = Operational Conservatism

Between Medicaid uncertainty, rate freezes, and ongoing staffing cost inflation, many providers are shifting from expansion to efficiency.

Expect more focus on productivity, credentialing, and automation — and fewer aggressive hiring waves.

📉 M&A at the Top: Still Missing in Action

The Top 20 remain untouched by major M&A, despite many being well past their original hold timelines.

The longer that continues, the more pressure investors may feel to justify valuations, pursue alternative exit strategies, or shift focus to bolt-ons and tuck-ins.

📬 Want to see SCUBA charts, platform cards, or spotlight stories?

Visit missionviewpoint.com

And if you’re scaling, investing, or trying to make sense of where the market’s heading — I’d love to connect.