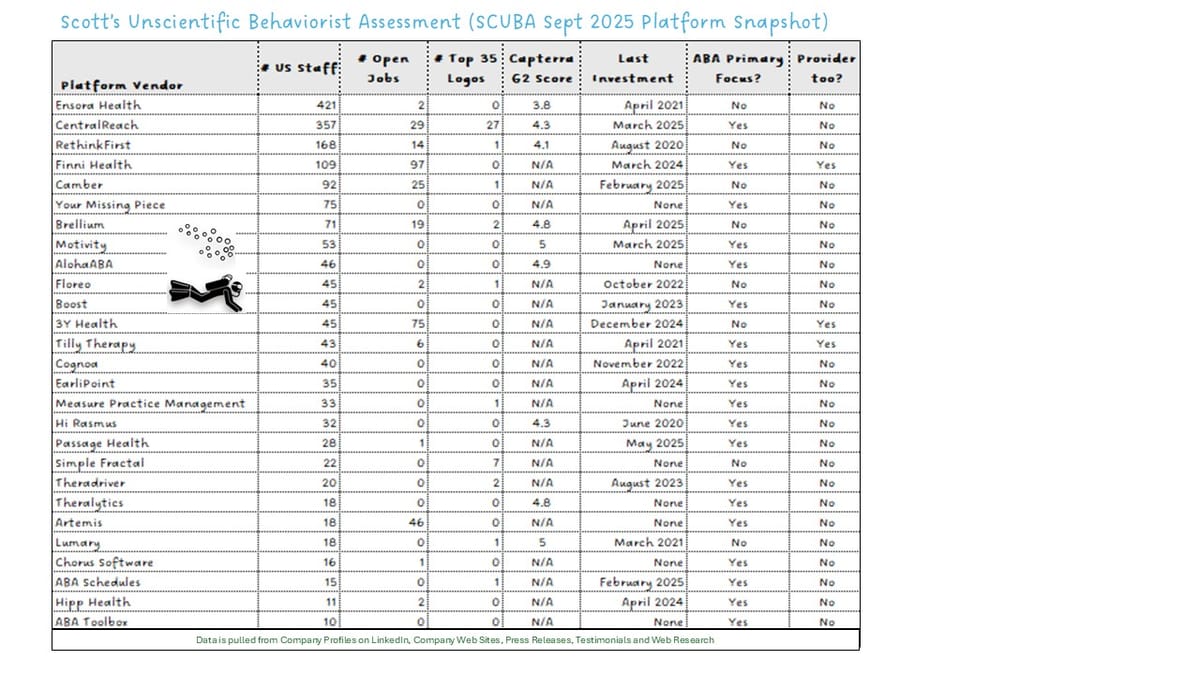

🔎 September 2025 SCUBA Platform Update

This month’s SCUBA shows measured movement across the ABA tech ecosystem, with several vendors expanding horizontally or deepening feature sets, while others signal continued consolidation and product maturity.

👉 Subscribe to the ABA Mission Newsletter for regular insights into ABA strategy, tech platforms, and investment activity:

🔗Subscribe here

✅ Platform Milestones & Product Enhancements

- CentralReach launched ClaimAcceleratorAI, an AI-powered claims recovery tool that helps providers identify and resolve denials faster, improving cash flow and reducing administrative workload.

- CentralReach also has had some notable changes in the C-Suite that I will cover in a separate post.

- Artemis ABA became the first NADR-compatible platform, simplifying provider participation in the National Autism Data Registry and reducing the lift required for standardized reporting.

- AlohaABA announced expansion beyond ABA, developing tools for occupational, physical, and speech therapy practices.

- Ensora Health enhanced its Experience Hub with community chat, live training, and unified ticket tracking.

- Brellium launched an E/M Coding Module, providing visibility into encounter-level coding accuracy and compliance risk.

- Passage Health released a new Authorization Utilization Report, giving real-time visibility into scheduled, completed, and billed hours versus client authorizations.

- Hipp Health raised $6.2M in seed funding (led by RTP Global) to expand its behavioral health platform, with ABA as its first ambulatory care market before branching into OT and speech therapy.

- ABA Toolbox announced that AWS is leading its current funding round and that it has been selected for NVIDIA’s startup program, giving it access to advanced AI tools and validation of its collaborative care model.

✅ Growth & Hiring Signals

No new Top 35 ABA provider logos were added this month, though hiring remains steady among expansion-stage vendors.

✅ SCUBA Data Refresh

The dataset has been fully updated to include:

🔹 U.S.-based headcount

🔹 Open job postings

🔹 Top 35 provider traction

🔹 Platform funding history

🔹 ABA-centric commercial focus

🔹 User ratings (Capterra, G2)

🔄 Dataset Updates

- Added: Cognoa, EarliPoint, and Your Missing Piece — all platforms primarily focused on the ABA market.

- Removed: Silna Health (broader behavioral health focus) and vendors with <10 U.S. staff.

🧪 The full dataset provides a detailed view of where ABA tech platforms are expanding, consolidating, or diversifying into adjacent therapy markets.

👉 As always, I welcome feedback, corrections, or additions from the field.