The Private Equity Dilemma in ABA

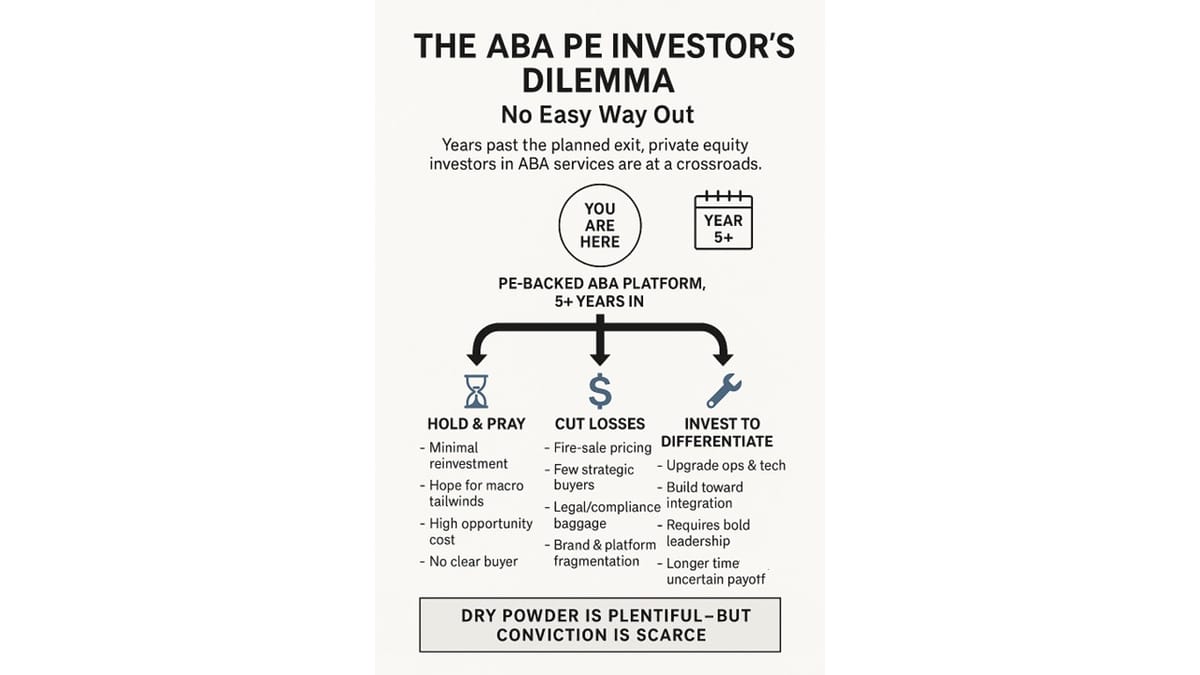

A few years ago, a wave of small and mid-sized private equity firms aggressively acquired ABA providers. Fueled by hopes of rapid scaling and a quick flip, these investors expected solid exits within 3–5 years. For many, that timeline has come and gone — and now, they face a dilemma.

Do they:

- Keep investing time, energy and money into their ABA platform, even as other portfolio companies promise higher returns?

- Exit at fire-sale prices — assuming they can even find a buyer?

- Or, double down to create real differentiation and integration — betting that this will make the asset more valuable long term?

None of these paths are easy.

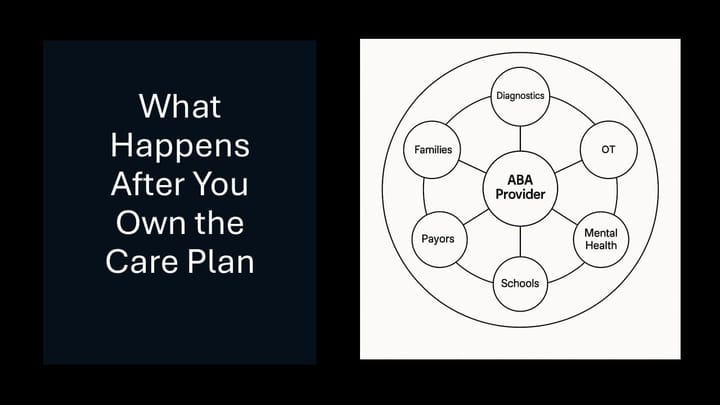

The ABA market is notoriously difficult to scale:

- Fast growth often compromises quality.

- Reimbursement rates — especially Medicaid — are under pressure.

- Commercial payors are scrutinizing rising ABA costs.

- Legal and compliance risk (e.g., clawbacks, labor law class action lawsuits) often spikes after acquisition.

- Integration across acquired providers is hard: branding, clinical practices, and tech stacks vary wildly.

- Staff turnover and client wait lists.

That’s why most large providers today grow via de novos — not M&A. I love Rohit Verma's “10 Questions in 10 Minutes” series. I can't recall a single CEO stating that they are looking to grow through large acquisitions. Instead, they prefer organic growth that is easier to align with their existing playbook.

So yes, M&A in the top 50–150 provider segment is picking up again, but many of those deals resemble de novos more than true roll-ups to me.

Private equity investors are incredibly smart — but I suspect many underestimated the operational nuances of ABA. I’ll never forget a meeting I had years ago after evaluating a provider’s tech stack, where I noted the IT spend was just a fraction of what you'd see in other healthcare sectors. A partner at the firm replied:

“I treat IT like marketing — a waste unless it drives immediate ROI.”

That mindset may not have been overly common, but it could help explain why so many providers remain trapped in underpowered PM platforms, unable to consolidate data or adopt AI and automation effectively.

And yet — PE funds are still sitting on massive reserves of dry powder that need to be deployed. As The Braff Group noted at AIS 2025, despite macroeconomic uncertainty and rising interest rates, the capital is there. The question is whether firms are willing to back ABA platforms again, knowing how bumpy the road has been. (I kind of think if they could go back in time and dodge this space, many would.)

So what are the real choices?

- Wait it out and hope market conditions shift — a risky, passive bet.

- Invest deeply in operations, technology, and leadership to build something scalable and differentiated.

- Pivot — expand into adjacent services, launch a tech solution, or reimagine delivery models (e.g., Frontera’s phenotyping approach or AnswersNow’s virtual model).

But a clean exit? That feels elusive for most.

📉 Most large buyers are sitting out.

📈 Smaller deals are happening, but often with strategic fits or operational simplicity.

🧠 Strategy, not scale alone, is what creates value in this space.

Note: This post focuses on private equity investments in ABA service providers — not ABA technology platforms, which I’ll cover in a future post.

Click here to subscribe for more insights on ABA technology, operations, and strategy.