Why the Viventium–Apploi Deal Makes Sense — and Why I Expect More Platform Consolidation Ahead

The acquisition of Apploi by Viventium is easy to read as a straightforward adjacency play: hiring meets payroll, ATS meets HR.

That framing understates what’s actually happening.

This move targets one of the most fragile points in ABA operations — the handoff between candidate, employee, and billable clinician — and it reflects a broader dynamic I’ve been watching on the ABA Platform side of the market for some time.

A quick note on consolidation expectations

Readers of this site know that I haven’t been particularly bullish on large-scale M&A in the ABA Provider space. That skepticism isn’t about capital availability; it’s about operational reality. Fragmentation, payor complexity, and workforce constraints make true integration difficult at scale, even when deals close.

The Platform market is a different story.

Here, consolidation is less about financial engineering and more about execution — collapsing fragile handoffs, reducing integration debt, and owning operational choke points that providers repeatedly struggle to manage.

For that reason, I’ve long expected consolidation to show up first — and more meaningfully — among Platforms.

I don’t view this announcement as an outlier. I expect more.

Why the platform market is under different pressure

The platform landscape in ABA is crowded, particularly across hiring, HR, compliance, scheduling, and revenue workflows. At the same time, growth at the top end of the provider market is increasingly constrained by change management tolerance, not interest.

Large, multi-state providers may want better systems — but they approach major stack changes with anticipation and trepidation. Replacing a practice management system carries real operational risk, long implementation timelines, and institutional memory of prior rollouts that went poorly.

As a result, platforms face a structural ceiling:

- Demand exists

- Budgets exist

- Appetite for disruption is limited

- That combination doesn’t kill deals — it reshapes which deals are possible.

That reality favors consolidation around adjacent, execution-critical functions that can be unified without “re-plumbing” the core clinical system.

Hiring, onboarding, payroll, and retention sit squarely in that category.

These functions already behave like a single system in practice — even if they’ve historically been sold, implemented, and governed separately.

Why workforce adjacency keeps showing up in my writing

This pattern isn’t new.

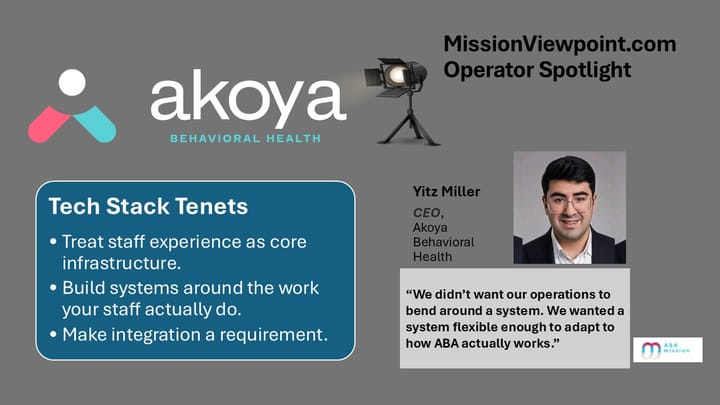

From the operator side, I’ve written about organizations like Akoya that treated workforce stability as clinical infrastructure, not an HR afterthought — designing onboarding, payroll clarity, and early-stage support before growth made those seams brittle.

From the platform side, I’ve repeatedly returned to the same gap: the space between offer accepted and first session delivered. It’s where ATS tools typically hand off, HR systems partially engage, and practice management platforms haven’t yet taken ownership — and it’s where invisible attrition quietly erodes capacity.

Across those posts, the conclusion is consistent: fragmentation across hiring, HR, payroll, and clinical systems creates predictable failure points that no single tool historically owned end to end.

Seen through that lens, platform consolidation around workforce infrastructure isn’t about chasing an “all-in-one” vision for its own sake. It’s about collapsing seams that already function as one operational pathway in reality.

What this deal does — and what it doesn’t

This acquisition doesn’t eliminate the need for strong clinical systems. It doesn’t solve supervision, scheduling optimization, or payor-driven utilization constraints.

What it does do is tighten control over a workflow that determines whether capacity ever materializes in the first place.

Owning hiring signals, onboarding progress, credential readiness, and payroll execution inside a single platform materially reduces:

- Dropoff between offer and start

- Ambiguity around employment status

- Payroll distrust tied to opaque calculations

- Manual reconciliation across systems that were never designed to coordinate

That’s not a minor optimization. It’s an attempt to stabilize the supply side of care delivery.

Why I expect more moves like this

In a market where:

- Providers are cautious about core system replacement

- Platforms face limited up-market expansion without deeper ownership

- Execution risk concentrates at predictable seams

Consolidation around adjacent, strategic functions becomes the path of least resistance.

That’s especially true for workforce infrastructure, where the ROI is indirect but foundational: fewer failed starts, more predictable staffing, and less operational drag before revenue ever shows up.

This deal fits that pattern cleanly.

And based on the structural pressures shaping both provider behavior and platform growth, I don’t expect it to be the last.