Automation Can Accelerate ABA Billing — But Only If Payor Knowledge Keeps Pace

Bots, AI, and automation are reshaping revenue cycle management, but clean data and payor expertise still decide who gets paid.

For most ABA leaders, the RCM question used to be: Who does the billing?

Today, it’s: How well does your billing logic reflect payor reality?

This post builds on my August overview of RCM vendors and platforms — and argues that even the best automation can’t replace payor intelligence, clean data, and internal ownership of the process.

ABA providers are investing in RCM automation at record pace. From bots that scrape Practice Management claims to AI engines that predict denials before submission, the future feels faster — and in many ways, it truly is.

Well-designed automation can now handle high-volume, rules-based billing tasks — accelerating payment posting, eligibility checks, and claims follow-up while improving consistency and scalability across large billing operations.

Yet even as automation improves, denials persist. They rarely stem from technology failure. Instead, they trace back to misaligned documentation, incomplete data, and gaps in payor alignment — issues that automation alone can’t fully resolve.

The Automation Wave Is Real — But Fragmented

ABA RCM has entered its “platform moment.” Every major vendor now promises faster cash and fewer denials — but their methods differ:

- Camber built a claims-first workflow embedding thousands of payor rules and denial patterns into submission logic — boosting first-pass acceptance for multi-state providers.

- Simple Fractal, by contrast, focuses on cross-platform automation — connecting workflows across systems like CentralReach and Catalyst — rather than embedding automation within a single platform.

- Motivity, Passage Health, Lumary, and Rethink have expanded their practice-management stacks to blend scheduling, documentation, and billing, promoting a single flow of data from intake to claim.

- CentralReach continues to fold AI into its billing suite — ClaimCheckAI® and ClaimAcceleratorAI™ — to improve audit readiness and reduce manual rework.

- Silna Health raised $27M to automate prior authorizations and eligibility workflows with payor-specific logic.

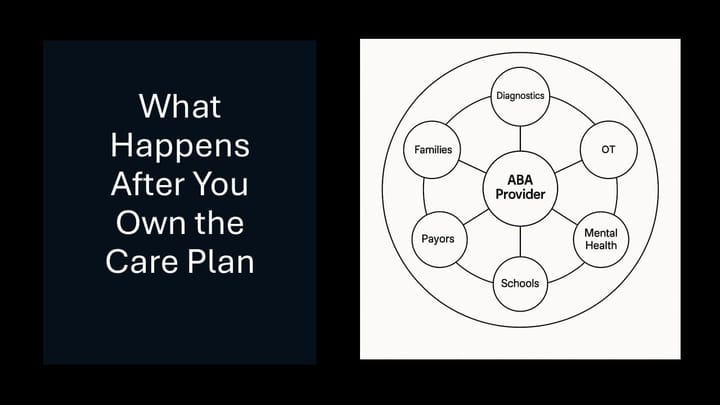

- And Frontera, while not an RCM platform per se, is pushing the frontier of clinical-financial alignment by using AI to ensure treatment plans meet payor medical-necessity standards before billing even begins.

Each of these companies accelerates the path to clean claims in its own way — but all depend on one fragile foundation: accurate, payor-aligned data.

The Human Layer Behind the Automation

Automation may move data faster, but human payor intelligence still drives the results.

Firms like Plutus Health, Your Missing Piece, BillMax, ASP-RCM, and SimiTree Behavioral Health combine traditional billing operations with deep institutional knowledge built across thousands of ABA claims.

They know:

- Which payors automatically reject certain CPT combinations.

- How to manage Medicaid MCO retro-auth timelines by state.

- What documentation phrasing triggers medical-necessity denials.

- And which appeal paths deliver the fastest reversals.

For newer or fast-scaling ABA providers, these partners can compress years of payor learning into months, giving them immediate revenue velocity while internal billing teams are still finding their footing.

Their value isn’t just automation — it’s the lived knowledge of payor nuance: understanding why a claim was denied, not just that it was.

But there’s a trade-off.

- When efficiency lives outside your walls, so does your data and decision logic.

- Relying solely on outsourced RCM can leave you with clean AR reports — but limited visibility into the root causes of denials, underpayments, or authorization drift.

- For providers aiming to mature their own revenue operations, that’s a critical blind spot.

When Payor Knowledge Becomes the Product

Not all RCM vendors are just moving data faster — some are transforming payor intelligence itself into a product. That’s what makes them so powerful for new and rapidly growing organizations.

Modern service and platform models now offer:

- Plan-specific denial libraries that flag high-risk CPT and modifier combinations.

- Pre-submission validation that matches authorizations to claims in real time.

- Predictive analytics that anticipate missing documentation or invalid plan codes before submission.

For younger provider organizations, these features can sustain cash flow while teams mature. A skilled RCM partner doesn’t just submit claims — they rent you their experience, bridging the early-stage knowledge gap that stalls many new entrants.

The challenge, of course, is balance: how long do you rent before you own?

The Economics Behind the Promise

Behind every automation or outsourcing pitch sits a revenue-model decision:

- Automation tools (bots, AI, and integrated workflows): Reduce manual workload and error rates but still depend on accurate data and disciplined processes.

- Outsourced RCM: Reduces staffing pressure but can erode margins via percentage-of-collections pricing. Efficiency gains are shared, not owned.

- Embedded Automation: Speeds up workflows but depends heavily on configuration discipline — garbage in still means denials out.

- AI-Assisted Pre-Billing: Moves quality control upstream but requires clinical buy-in and process redesign.

- Hybrid Models: Pair automation with internal oversight — ideal for mid-sized providers but reliant on cross-department coordination few have mastered.

Every approach solves a real problem. The key is knowing which problem you’re actually trying to solve — capacity, accuracy, or insight.

Why Denials Persist, Even in 2025

Even with automation and expertise, the same issues recur:

- Medical-necessity gaps: Plans don’t tie assessment results to CPT codes or service frequency.

- Authorization drift: Units or codes evolve mid-plan without corresponding updates.

- Cross-module inconsistency: Scheduling, documentation, and billing remain siloed — even in “all-in-one” systems.

- Staff turnover and variable payor literacy: New billers relearn the same rules every six months.

Automation accelerates these steps — it doesn’t yet govern them.

How Leading Providers Balance Speed and Control

The best-run ABA organizations don’t choose between automation and outsourcing — they orchestrate both around internal ownership.

They:

- Leverage external payor intelligence — but internalize it quickly. Use vendor expertise to accelerate learning curves, then document it internally.

- Invest in process QA, not just automation. Cross-check plan, CPT, and documentation alignment before submission.

- Measure ownership, not just outcomes. Track not only cash velocity but how much of your payor intelligence is truly internal.

Questions to Ask Before You “Automate” or “Outsource” RCM

Strategic Fit

- Are we buying a service, a system, or payor intelligence?

- If the vendor disappeared tomorrow, how much of our process would we still understand?

Economic Model

- How do fees scale with collections or claim volume?

- As first-pass rates improve, do costs fall — or stay flat?

Payor Alignment

- How often are payor rules updated and validated?

- Can the vendor show measurable differences in denial rates by payor or region?

Data & Transparency

- Do we have full access to denial reasons, appeal outcomes, and audit logs?

- Can we export our entire claim and denial dataset if we move vendors or systems?

Practical Next Steps

- Map your RCM ecosystem. Identify where each step — from authorization to payment — actually lives.

- Audit your vendor dependency. Document what payor knowledge you control vs. what’s embedded in partner systems.

- Negotiate visibility clauses. Ensure your RCM contracts require transparency into denials, adjustments, and payor rule changes.

- Establish quarterly reviews. Trace denials to root causes and update internal playbooks accordingly.

- Plan your handoff. Early-stage providers may need outsourced speed — but mature ones should aim for internal ownership.

Final Thought: Borrow Speed, Build Understanding

Automation and outsourcing can accelerate growth — but lasting RCM maturity comes from owning the knowledge that drives your revenue.

Borrow speed when you must.

Build understanding as soon as you can.

Your cash flow depends on more than speed.

It depends on how well you learn from the systems and people handling your claims.

Want more insights on tech, ops and data? Subscribe here