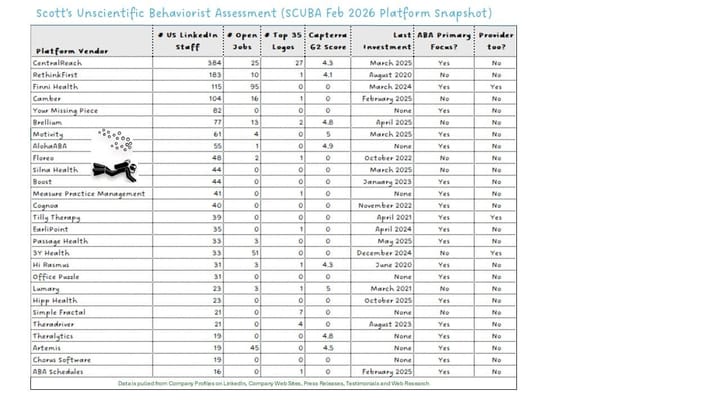

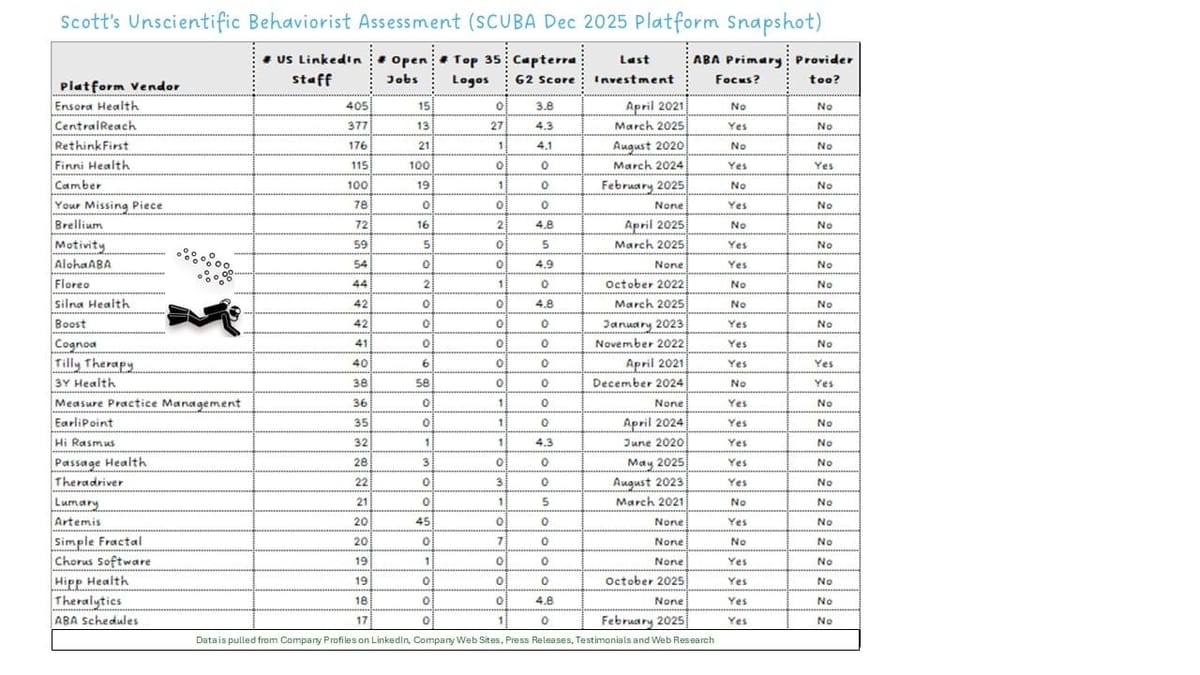

December 2025 Platform SCUBA Update

From divergence to intent

If October felt like a systems check, and November marked a divergence point, December shows intent.

Platforms are no longer just accelerating — they’re becoming clearer about what kind of complexity they are preparing for as ABA providers brace for tighter margins, higher payor friction, and operational volatility heading into 2026.

📉 Market Signals & Positioning

The divergence observed in November persists:

- Platform vendors continue to invest while providers remain cautious.

- Hiring and product investment are increasingly selective, not broad-based.

What’s changed in December is where platforms are placing their bets.

Rather than building for provider growth, platforms appear to be building for:

- Greater payor and coverage complexity

- Margin pressure that requires operational leverage, not headcount

- Enterprise trust, compliance, and financial visibility

- Workflow realism over surface-level feature velocity

This reframes November’s question:

Platforms are not betting on growth.

They’re betting on complexity.

Against that backdrop, here are the new signals that mattered in December:

✅ Platform Milestones & New Signals

- Theralytics completed a SOC 2 Type II audit, signaling the importance of data stewardship and HIPAA compliance.

- Artemis launched Insurance Discovery, extending RCM upstream to uncover undisclosed or inactive coverage (commercial, Medicaid, Medicare) — reflecting growing recognition that revenue leakage often begins before claims submission.

- Flychain and TheraDriver announced a strategic partnership aligning ABA scheduling and utilization improvements with downstream financial visibility and margin decision-making — a positioning move rather than a product integration.

- Passage Health introduced goal grouping and more flexible multi-data programming, reinforcing a broader shift toward workflow realism and clinician cognitive-load reduction rather than feature expansion.

- CircaThera rebranded from ABA Toolbox.

🧪 SCUBA Dataset Refreshed

This month’s update continues to track:

- U.S. headcount

- Job postings

- Top-35 provider traction

- Investment history

- ABA market focus

- Capterra / G2 ratings

Together, these indicators suggest fewer generalist strategies and more explicit positioning around payor complexity, operational leverage, and enterprise readiness as 2026 approaches.

One additional observation I’m watching heading into 2026: unlike the provider side, where transaction activity remains constrained, the platform landscape feels increasingly set up for selective consolidation.

👂 Feedback Welcome

As always, I welcome updates, corrections, or additional platform milestones from the field.

Your input helps keep SCUBA directionally useful for operators, vendors, and investors navigating a rapidly evolving ABA ecosystem.