January Payor Changes: A Provider Problem that is best mitigated with Process

Every January, ABA providers face a predictable but still under-managed risk: payor coverage changes that quietly invalidate assumptions made in December.

Member IDs may remain the same.

The payor brand may not change.

But benefits, product structures, authorization requirements, and family financial behavior often do.

The result is a familiar Q1 pattern:

- Sessions delivered under incorrect eligibility assumptions

- Prior authorizations that expired on December 31

- Claims rejected weeks later

- Intake, clinical, and billing teams forced into rework

Despite years of awareness, this remains largely a provider process problem to address, not one cleanly solved by platforms.

Why January Continues to Break Otherwise “Stable” Operations

January payor disruption is not a single failure point. It is a sequence failure:

- Coverage appears active

- Plan or product structure changes

- Prior authorizations terminate or change scope

- Services continue uninterrupted

- Revenue risk is discovered downstream

Most systems only operate at one layer of this chain.

Eligibility tools confirm that something is active.

RCM systems surface issues after claims fail.

Practice management systems often store insurance as static data rather than a changing state.

That gap is why January still hurts.

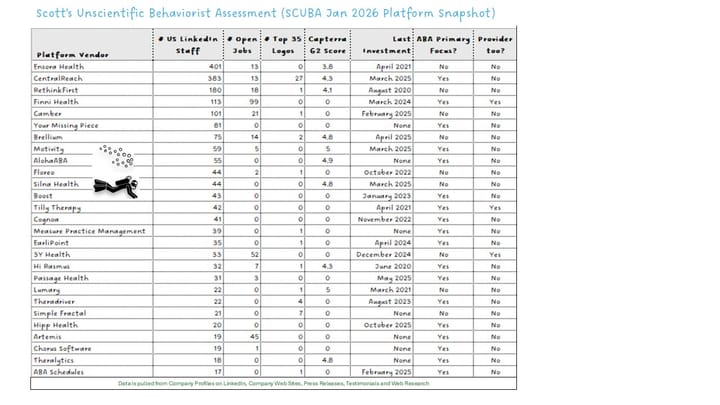

The Mission Viewpoint Assessment: No Platform Fully Owns This Today

After reviewing current capabilities across practice management, RCM, eligibility, and authorization tooling, the reality is straightforward:

There is no platform today that reliably detects plan equivalence changes, enforces authorization continuity, prevents invalid scheduling, and closes the loop before care or revenue disruption occurs.

What exists instead are tools that can support a disciplined process—but do not replace it.

What Actually Works: A Process-Led January Operating Model

Providers that consistently manage January well do not rely on automation alone. They institutionalize three controls.

1. Explicit January Eligibility Re-Verification

High-performing providers treat eligibility re-verification as a time-bound operating event, not an ad-hoc task.

Effective practices include:

- Structured eligibility checks in December and early January

- Focus on plan and product equivalence, not just payor name

- Clear internal flags for verified vs assumed coverage

This is procedural discipline, not a software feature.

2. Authorization Lifecycle Governance

January failures are often authorization failures discovered too late.

Providers that avoid this:

- Track authorization expiration dates explicitly

- Initiate re-authorization workflows before December 31

- Assign clear ownership across intake, clinical ops, and billing

Authorization must be treated as a renewable lifecycle, not administrative paperwork.

3. January-Specific Risk Visibility

January requires different management attention than other months.

Strong operators:

- Track sessions delivered without confirmed eligibility

- Review early-January denial trends weekly

- Communicate proactively with families about deductible resets and coverage uncertainty

This reduces surprise cancellations, clinician disruption, and trust erosion.

January Payor Readiness Checklist

If January payor changes consistently create noise in Q1, the issue is rarely a single system or team. It is almost always a missing operating model.

Strong operators enter January with the following controls in place.

Eligibility Re-Verification

- December eligibility re-verification window defined

- Plan and product equivalence reviewed (not just payor name)

- Coverage explicitly flagged as Verified vs Assumed

- January eligibility exceptions tracked in a central queue

Authorization Continuity

- Authorization expiration dates explicitly tracked

- December re-authorization triggers in place

- Clear ownership across intake, clinical, and billing teams

- January services blocked or flagged without valid authorization

Financial & Family Readiness

- Deductible reset messaging prepared in advance

- January attendance risk modeled and monitored

- Families notified proactively of potential coverage changes

- Early-January cancellations reviewed for coverage-related patterns

RCM Feedback Loop

- January denial trends reviewed weekly

- Eligibility-related denials tagged distinctly

- Intake and scheduling teams informed by RCM findings

Operator signal:

RCM should confirm assumptions—not discover surprises.

Maturity Check

- Reactive: Issues discovered through denied claims

- Managed: Issues flagged after services are delivered

- Disciplined: Issues identified and addressed before care disruption

Where Platforms Can Be Leveraged (Without Over-Claiming)

Technology can help—but only inside a defined process.

Authorization Support Tools

Platforms such as Silna Health can reduce workload and variability once a need for re-authorization is identified. They are most effective when paired with a provider-led eligibility re-verification cadence.

They do not independently discover coverage changes—but they can meaningfully accelerate response once those changes are surfaced.

Insurance Discovery Signals in Practice Management

Some practice management platforms are beginning to treat insurance as a stateful object rather than static intake data.

In December, Artemis announced an insurance discovery capability intended to surface when active coverage no longer matches what is on file—particularly when plan or product details change at the calendar-year boundary even though member IDs remain the same. This can help teams identify January mismatches earlier than claim rejections alone.

This remains an early-warning signal, not a full resolution. Its value depends entirely on whether providers have clear January re-verification workflows and ownership in place.

RCM Vendors

RCM partners often identify January issues first—but typically after services are delivered. Their strength is containment and recovery, not prevention, unless tightly integrated with intake and scheduling governance.

What Platform Roadmaps Suggest (But Do Not Yet Deliver)

Across the ecosystem, vendor roadmaps increasingly point toward:

- Eligibility state awareness tied to scheduling

- Authorization expiry gating

- Faster feedback loops between RCM and intake

These are promising directions—but today they remain:

- Configuration-heavy

- Inconsistently enforced

- Dependent on operator maturity

Providers should plan accordingly.

The Takeaway for Operators

January payor changes are not an intake nuisance. They are a stress test of operational maturity.

Providers that manage January well:

- Treat it as a distinct operating season

- Lead with process, not platform selection

- Use technology as an accelerator, not a substitute

Until platforms fully own payor continuity across eligibility, authorization, scheduling, and billing, this remains a provider-run problem.

And that is not a failure—it is a leadership opportunity.

Want more insights on tech, ops and data? Subscribe here