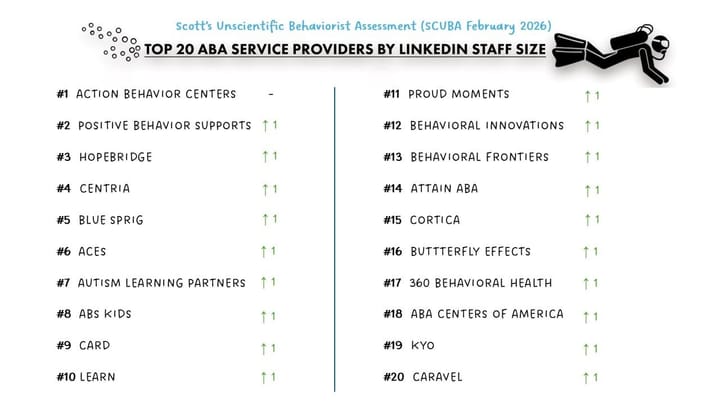

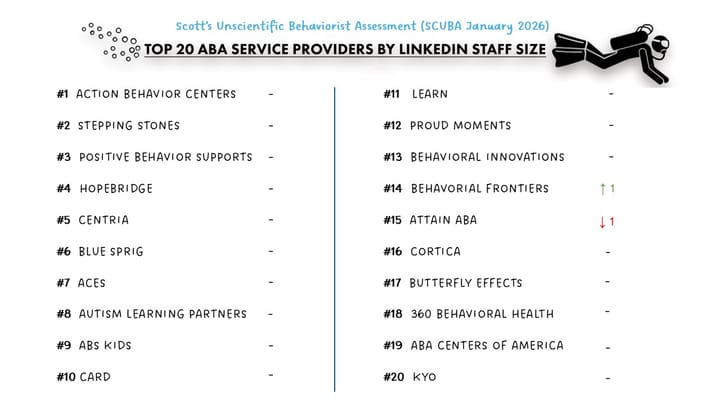

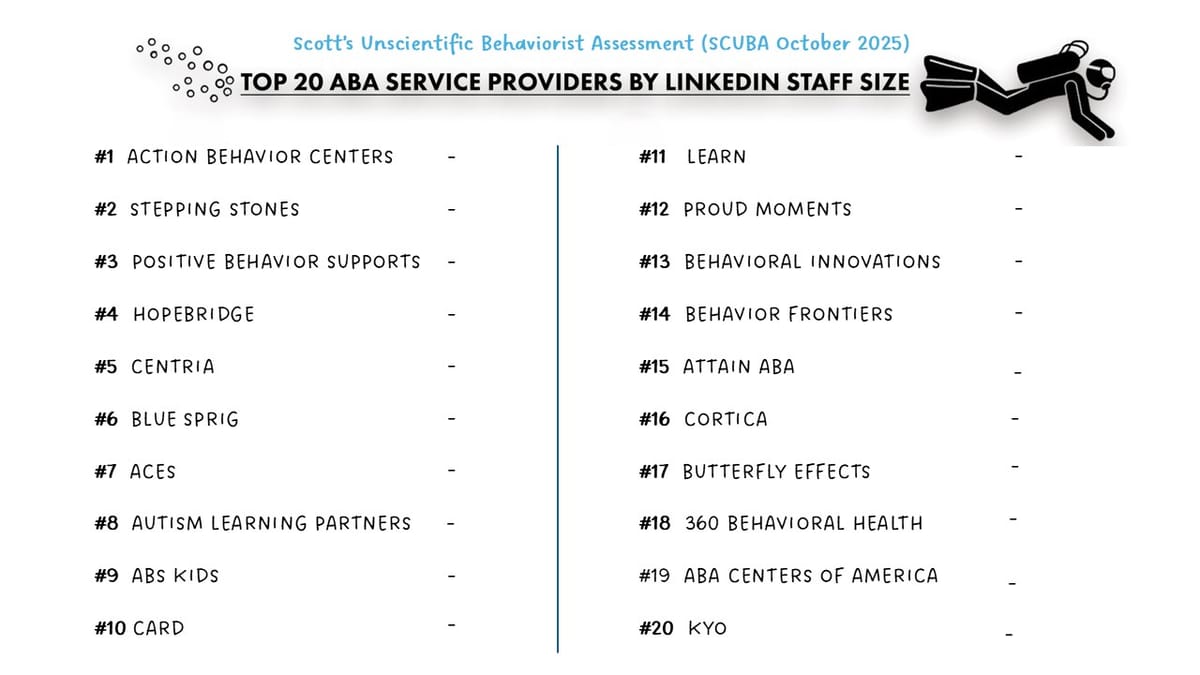

Provider SCUBA October 2025 Snapshot

Scott’s Completely Unscientific Behaviorist Assessment

⚠️ Methodology Reminder

This isn’t a census. LinkedIn misses many direct care staff, and headcounts can lag actual payroll. State counts come from provider websites, which may not always be current. But across 130+ providers, directional shifts highlight market momentum — which is often more useful than precision.

📈 October 2025 Snapshot – Steady at the Top

- Overall headcount for the Top 20 grew ~1.2%, nearly identical to September’s pace.

- The ranking itself stayed unchanged — no movement among the largest players — but hiring dynamics beneath the surface looked different.

- Job postings varied sharply by organization, signaling selective recruiting and a continued emphasis on efficiency over expansion.

- This month's Operator Spotlight featured ABA provider Yellow Bus ABA and their systematic approach to expansion in the New York market

- View Top 20 ABA provider profiles with commentary here

🚀 Hiring Reorganization and Selective Recruiting

- Action Behavior Centers headcount rose 2.1%, but their LinkedIn job postings disappeared entirely this month. Based on a review of their website careers page, total open roles are down nearly 50% from last month’s LinkedIn count — suggesting a shift in recruiting channels, not necessarily a slowdown in hiring.

- Centria Autism increased open roles by 15% — accentuated by growth in Oregon, Arizona, Michigan, and North Carolina markets.

- ABS Kids remains one of the most active recruiters (~700 roles open).

🌱 Mid-Tier Momentum Outpaces the Giants

While the Top 20 collectively grew roughly 1.2% in October, a set of mid-tier providers continued to expand at a meaningfully faster clip.

Standouts this month include:

- SOAR Autism Center — steady climb, + ~2%

- Yellow Bus ABA (this month's ABA Mission Viewpoint Operator Spotlight) — + ~3% as its New York model continues to scale with discipline

- Achievements ABA (prior Spotlight) — + ~6%, one of the fastest-growing mid-sized groups

- Positive Development (DRBI-focused alternative care model) — + ~3%, momentum following its recent $51.5M raise

- Golden Steps ABA — + ~4%, strong organic recruiting and expansion footprint

- Brighter Strides ABA — + ~2%, consistent growth across its service regions

Context:

These mid-sized organizations — each scaling through tight process execution and targeted regional strategy — grew 2–6× faster than the Top 20 average this month.

That divergence continues a 2025 theme:

Sustained, disciplined operators in the middle of the market are now growing faster than the largest incumbents.

💰 Capital Signals

No major ABA-provider transactions were announced in October, continuing a quiet stretch for large-scale M&A.

But beneath that silence, investor sentiment is shifting. Many are reassessing risk premiums tied to:

- Reimbursement rate variability across Medicaid and commercial plans

- The potential for significant funding or policy adjustments in 2026

- The emergence of alternative delivery models like DRBI, which could reshape cost structures and payer expectations

As a result, some investors appear to be taking a “wait and see” posture, watching to see how these dynamics evolve before re-entering the market at scale.

If you’re navigating these shifts — whether as a provider, platform, or investor — let’s connect. Interested in keeping pace with Tech, Ops and Data content? Subscribe here