The New ABA Operator Persona

How a new generation of non-clinical, tech-native founders is reshaping how ABA organizations scale

A Different Kind of ABA Leader

For much of the industry’s history, providers were led either by clinicians (BCBAs who grew into executives) or private-equity-backed operators focused on rapid scaling. Both models had clear strengths, but each carried structural limits: clinicians often lacked operational depth, while PE leaders inherited playbooks that didn’t always match on-the-ground realities.

Now, there’s a third archetype taking hold — one I see repeatedly in my consulting work and platform research. These are the tech-ops-data operators: non-clinical founders who bring an analytical, systems-driven lens to ABA.

They’re not technologists in the Silicon Valley sense, but they are structured thinkers who recognize that good systems design drives better care delivery. They don’t build EHRs from scratch; they are pragmatic about software — and they’re often startled by how far ABA platforms diverge from the business ecosystems they came from.

Some of these new operators are what I think of as AI refugees — professionals coming from industries where automation, layoffs, and platform disruption have made career stability feel out of reach. For them, ABA represents a different kind of opportunity: a chance to own something real, to apply their operational and analytical skills in a domain where they can control the variables and build equity over time.

They’re not chasing altruism; they’re pursuing agency. Many watched technology redefine or erase their prior roles. Building an ABA business — however messy or fragmented — offers a way to reclaim that control. They see it as a field where disciplined execution still matters, where business results are tangible, and where smart systems can scale faster than headcount.

Their DNA: Tech-Comfortable, Process-Obsessed, and Resource-Constrained

The new operator profile looks different from both legacy and PE-era models.

- They’re tech-comfortable, fluent in tools like Monday, Airtable, and HubSpot, and comfortable experimenting with automation to close workflow gaps.

- They’re process-obsessed, documenting every intake, scheduling, and billing step before scaling headcount.

- They’re resource-constrained, often bootstrapping their first few hires and making pragmatic decisions that trade sophistication for speed. Many start with in-home models to avoid rent and capital costs, then expand to center-based care once cash flow stabilizes.

- They’re clinically adjacent — respectful of evidence-based practice but focused on the infrastructure that makes it sustainable.

They approach every problem like an operator, not an academic: “What’s the minimum system that keeps the business running, cash flowing, and the data credible enough to grow?”

What They’re Solving For

Their challenges look familiar — staffing shortages, payor complexity, and compliance risk — but the stakes feel higher. Bootstrapped operators don’t have a six-month runway to fix broken workflows. Cash flow is existential. A single problematic payor relationship can stall payroll or expansion plans overnight.

They also wrestle with vendor uncertainty. They fear newer software companies may fall short in features and support. At the same time, they sense the brittleness of legacy platforms that move slowly or resist integration.

The result is a cautious middle ground: choose a system that will still exist next year, even if it isn’t perfect, and hope the ecosystem evolves before the next major investment cycle.

They spend much of their time reconciling what they thought a modern EHR could do with what ABA-specific platforms actually deliver. Many come from adjacent industries where integrations, APIs, and analytics are mature; they’re often surprised to find how closed or inconsistent ABA systems can be.

Their pain points cluster around:

- Fragmented communication between intake, scheduling, and billing

- Slow, opaque payor processes that disrupt cash flow

- Limited visibility into KPIs, utilization, and authorizations

- A need to scale capacity without expanding non-billable staff

- Vendor ecosystems that don’t match their expectations for interoperability

They adapt quickly, but they’re constantly balancing innovation with survival — tightening feedback loops, piloting tools, and buying time to see where the next reliable platform emerges.

Their Tech-Stack Patterns

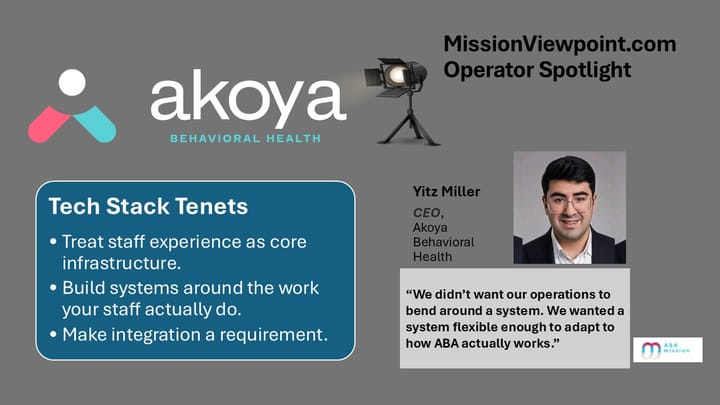

If you want to understand how these operators think, look at their tech stacks.

- They start with horizontal tools — Monday for tasking, Google Workspace for documentation, ZoHo for CRM — because they can control and adapt them.

- They automate early and often, connecting systems with Zapier, Pabbly, or Make.

- Their “data warehouse” is usually a collection of Google Sheets and dashboards, stitched together through API pulls or manual exports from their clinical and billing platforms.

It’s a pragmatic evolution: build first, integrate later. For teams under 100 staff, this approach can outperform many enterprise systems in both cost and agility.

But as they grow, the same flexibility that once fueled them can start to create friction — redundant data, mismatched fields, and fragile automations that depend on a single admin to maintain.

Their Blind Spots

These founders’ strengths can also become their vulnerabilities.

- Data integrity can erode quickly without a single source of truth.

- Scalability becomes an issue when automations are complex and/or maintained manually.

- Security and compliance risks increase when non-HIPAA tools handle PHI.

- Change fatigue spreads as staff adapt to new processes every few months.

They know enough to move fast — sometimes faster than the infrastructure can support. The result is a kind of operational debt: clever systems that work beautifully until they suddenly don’t.

Still, it’s a better problem than inertia. These operators learn by doing, and they rarely wait for permission to fix inefficiency.

Implications for Vendors, Investors, and Consultants

This is where the story connects to the broader ecosystem.

In my earlier piece, Cracking the Code: Selling Tech into the ABA C-Suite, I described how platform vendors often have to navigate a fragmented leadership table — where each executive owns a different operational pain point.

The new operator archetype changes that dynamic. Their roles are fluid and fungible, often blending tech, ops, and data responsibilities depending on bandwidth and expertise.

When they hit a ceiling, they don’t spin up committees — they bring in fractional talent or consultants to move faster. That flexibility makes them more decisive buyers and more collaborative partners for vendors that can meet them at their level.

For investors, this segment represents the next wave of mid-market growth. These owners are disciplined, data-literate, and highly coachable. They don’t need a 50-page deck to understand ROI — they want to see a working model.

For consultants, they’re the ideal partner: decisive, engaged, and open to outside expertise. They understand the value of specialized guidance and rarely require a long justification process to approve it.

And for platform vendors, the takeaway is clear: these are not legacy buyers. They’re systems thinkers who evaluate products based on fit, not flash. They expect interoperability, responsive support, and credible domain expertise.

The Operator Era

The rise of this persona signals a cultural shift in ABA.

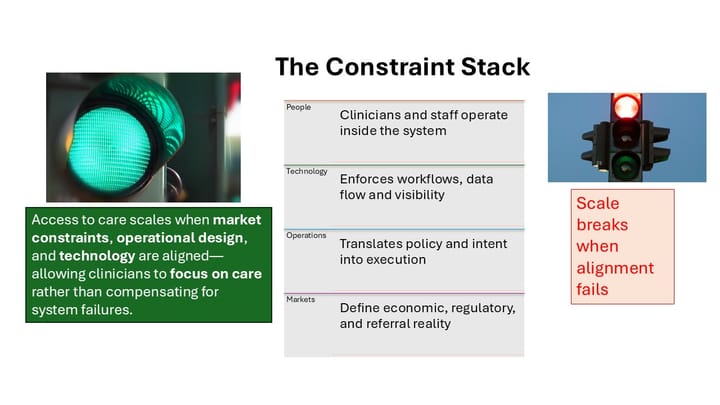

Where once the goal was to make clinicians more efficient, now the goal is to make operations itself a strategic advantage.

These operators are turning practice management into a design discipline — treating every workflow, report, and automation as a product to be refined. They’re not replacing clinicians; they’re enabling them to focus on care by removing operational friction.

As the industry matures, this mindset will likely shape which platforms win, which providers scale, and how investors evaluate operational excellence.

They’re not just optimizing workflows.

They’re turning operations into strategy.

Want more insights on tech, ops and data? Subscribe here