📬ABA Mission Viewpoint Monthly Update – November 2025

The Mission of ABA Mission

👉To drive more—and better—access to ABA care through the smarter use of technology and data.

Welcome to the November 2025 Monthly Update

This month’s theme is Building Agility under Payor Pressure & new Therapy Delivery models.

Across the ABA landscape, pricing pressure is no longer theoretical—it’s operational. States and payors are reshaping the rules through narrower networks, therapy-dosage caps, and evolving behavioral health management models.

Idaho’s recent decision to remove Magellan as its statewide BHMO may be a preview of what’s ahead, as autism services move closer to whole-person care and further from traditional carve-outs. This could drive fundamental changes in how therapy is delivered - and introduce new methods that live alongside ABA.

For providers, this means survival isn’t just about working effectively within today’s payor frameworks—it’s about being nimble enough to pivot when those frameworks change.

That same discipline feeds a new kind of leadership culture—one that designs processes before scaling technology and measures impact before chasing growth.

My focus is on the non-clinical aspects of this dynamic to include areas such as:

➡ Revenue discipline — treating RCM as a source of operational intelligence that enables quick maneuvering when reimbursement structures shift.

➡ Operator evolution — the rise of the tech-ops-data operator, a new class of leaders using process design and data visibility to build resilience under payor scrutiny and change.

➡ Systemic scaling — providers like Yellow Bus ABA, proving that steady, process-first growth can outperform expansion-for-expansion’s-sake in a complex reimbursement environment.

The story of ABA is no longer about who can grow fastest—it’s about who can adapt quickest and signal value most clearly as the payor landscape continues to evolve.

Below are this month’s highlights—each exploring how agility, alignment, and analytics are shaping the next chapter of ABA operations.

🧾 RCM and the Payor Relationship

As payors experiment with utilization limits and new reimbursement structures, revenue-cycle management (RCM) is becoming a form of defense as much as offense.

In this month’s post, I explored how every pre-auth, claim, and concurrent review can serve as evidence of value—if data and process are aligned. RCM can no longer be a back-office function; it’s an intelligence layer that shows how effectively therapy hours translate into quality - and operating margin.

Takeaway: The better your operational readiness, the stronger your position. Clean data flow and disciplined workflows turn compliance into credibility—and credibility into leverage when reimbursement pressure rises.

👤 The New ABA Operator Persona

As payors tighten reimbursement and regulators scrutinize dosage and delivery models, a new kind of ABA leader is stepping forward—the tech-ops-data operator.

These founders aren’t clinicians-turned-executives or PE-backed roll-ups chasing scale. They’re systems thinkers—non-clinical, tech-comfortable, and relentlessly process-driven. Their advantage is structural clarity: they understand that how care is delivered is now inseparable from how it’s operationalized.

Under growing payor pressure, they’re solving for control:

- Financial control, through automation of authorizations, claims, and cash-flow tracking.

- Data control, by reconciling disconnected systems into a single source of truth.

- Operational control, by treating workflows as design problems instead of administrative chores.

These operators aren’t waiting for payors to define “value.” They’re already building the infrastructure to prove it—tight process loops, credible data, and measurable outcomes.

Takeaway: This new persona turns operations into strategy, builds resilience through data, and sees every RCM, scheduling, or engagement process as a product to be refined. As pricing pressure mounts, they may be the ones best positioned to adapt—and to set the new standard for scalable, accountable care.

🚌 Operator Spotlight: Yellow Bus ABA

In a state where payors are tightening reimbursement and regulators are watching therapy utilization, Yellow Bus ABA has found a way to scale responsibly— growing within the constraints of New York’s complex funding landscape.

Their leadership team didn’t rush to open new markets; they focused on refining the systems that make each site sustainable. Scheduling, clinical supervision, and family engagement are all synchronized through a tightly designed operational rhythm that balances access, quality, and cost control.

That discipline has enabled steady, durable expansion—the kind that withstands reimbursement shifts and workforce volatility. It’s a model of process-first scaling, not footprint avoidance.

Takeaway: Resilient growth comes from alignment, not acceleration. In a cost-sensitive environment, Yellow Bus shows that operational maturity—and empathy for both families and staff—can outperform volume-driven growth.

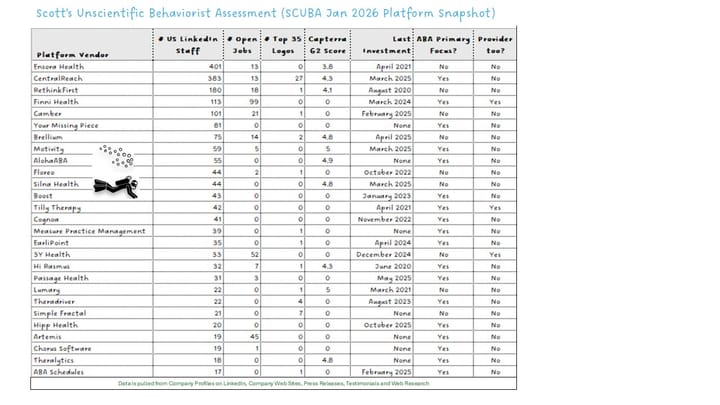

✅ Platform Highlights

If September felt like a sprint, October felt more like a systems check. Most platforms held hiring steady, sharpened integrations, and doubled down on automation discipline.

- Passage Health introduced an AI-powered session-note feature, strengthening its workflow-efficiency toolkit and reinforcing its Frontera partnership.

- Camber + Flychain announced a strategic partnership, bundling automated RCM, bookkeeping, and capital access to help smaller clinics improve cash-flow resilience and payor-performance visibility.

- EarliPoint Health (formerly EarliTec Diagnostics) rebranded, launching the EarliPoint Network to connect families with providers and accelerate treatment starts using its FDA-cleared eye-tracking diagnostic tool.

- Hi Rasmus and TheraDriver each added new Top-35 provider logos—signaling ongoing traction with mid- to large-sized organizations.

- No major funding rounds were recorded, and overall platform hiring cooled—reflecting a focus on product stability, integration, and margin discipline heading into year-end.

Takeaway: Platform momentum has shifted from expansion to endurance. Vendors are refining the systems they already have—preparing for a market that values interoperability, ROI, and outcomes over new features alone.

✅ Provider Trends

Overall headcount for the Top 20 ABA providers grew ~1.2 % in October, identical to September’s pace. Beneath that surface, mid-tier organizations continued to outgrow the giants by 2–6 ×.

- Standouts included SOAR Autism Center (+2 %), Yellow Bus ABA (+3 %), Achievements ABA (+6 %), Positive Development (+3 %), Golden Steps ABA (+4 %), and Brighter Strides ABA (+2 %).

- Hiring among large providers reflected selective recruiting rather than freeze or expansion—Action Behavior Centers and Centria Autism adjusted job-posting approaches, while ABS Kids remained one of the most active recruiters (~700 open roles).

- JoyBridge acquired Pediatric Advanced Therapy, a small but notable reminder that M&A activity isn’t completely dead, even as investors stay cautious.

- Investor sentiment continues to hinge on reimbursement variability, 2026 policy uncertainty, and the potential impact of DRBI and other hybrid therapy models on payor expectations.

Takeaway: Efficiency and adaptability are the new growth currencies. Mid-sized, process-driven providers are showing how discipline can outperform scale in a constrained market.

🧭 Events & Insights

Last month, I attended CentralReach’s annual user conference, CR Unite, where Peter Boumenot was announced as the new Product Leader, amongst a few C-Suite changes I noted in this post.

The event highlighted continued progress in CR Mobile, Claims, and RCM AI. It will be interesting to see how CentralReach differentiates its API and data-analytics approaches—particularly for larger customers looking to use their EHR/Practice Management data for both automation and KPI visibility outside of CR's walled garden (e.g. CR's Advanced Business Intelligence - ABI).

CentralReach also released its latest Autism & IDD Care Market Report, which shows that AI has moved from early adoption to operational infrastructure, with 75 % of providers now using AI-enabled tools for documentation, claim review, or scheduling.

The report highlighted several notable shifts:

- Clinic-Care Rebound: For the first time, more than 50 % of services in California are delivered in clinics rather than homes—signaling a national return to center-based care and the operational efficiency it enables.

- Integrated Models: Roughly 30 % annual growth in combined ABA + ST + OT + MH delivery reflects a continued move toward “whole-child” care.

- Authorized-Hour Gap: Providers are delivering only about 40 % of authorized hours, with caregiver-training utilization down to 20 %, highlighting both workflow and outcomes opportunities.

- Workforce Stability: Turnover remains high overall, though top performers have reduced attrition by as much as 70 %, reinforcing the impact of strong operational culture.

Overall, the report reflects a field becoming more data-driven, clinic-based, and multidisciplinary—a continuation of the broader shift toward coordinated, outcome-focused care.

Looking ahead, I’ll be attending AIS East (Nov 18–19 – Arlington, VA) to continue conversations with platform leaders, investors, and operators about how reimbursement models, automation, and outcome data intersect. If you’ll be there, reach out—these are the discussions shaping how care delivery and payor economics will converge in 2026.

💬 Closing Thoughts

This month made one thing clear: pricing pressure is now the organizing force across ABA. Payors, regulators, and investors are all asking the same question—what level of therapy delivers measurable value?

Providers that can connect process design, data integrity, and human outcomes will hold the advantage. Those that can’t will find technology choices—and reimbursement models—made for them.

Until next time, — Scott

P.S. Know someone leading ops, tech, or investment in ABA? Forward this to them—or invite them to join the hundreds of industry leaders already following missionviewpoint.com.

Not sure it's worth your time? Check out our reader testimonials.

Subscribe here.

ABA Mission

We offer consulting services to ABA Private Equity Investors, Providers and Tech Platforms looking to scale.

Reach me at scottd@abamission.com to learn more.