Clinician-First Platforms and the Franchise Future of ABA

Can infrastructure and autonomy coexist in a way that helps ABA scale?

Something is shifting in the ABA platform landscape.

Instead of big investments aimed at building national clinic networks, we’re seeing a new generation of platforms, such as —Tilly, 3Y Health, Alpaca and Finni Health —emerge with funding for a different model.

They support clinicians as entrepreneurs, not just employees.

They offer back-office infrastructure—billing, credentialing, compliance, payor management—so BCBAs can launch and grow practices under their own vision and brand.

And the idea is resonating.

I’m for Anything That Scales Good Care

Let me be clear up front:

✅ I’m in favor of any model that scales ethical, effective autism care.

✅ I want clinicians to have agency and tools—not just bureaucracy and burnout.

These new platforms are tapping into real needs: autonomy, flexibility, better alignment between clinical goals and business operations.

But they also raise important questions—especially as the ABA market matures and consolidates.

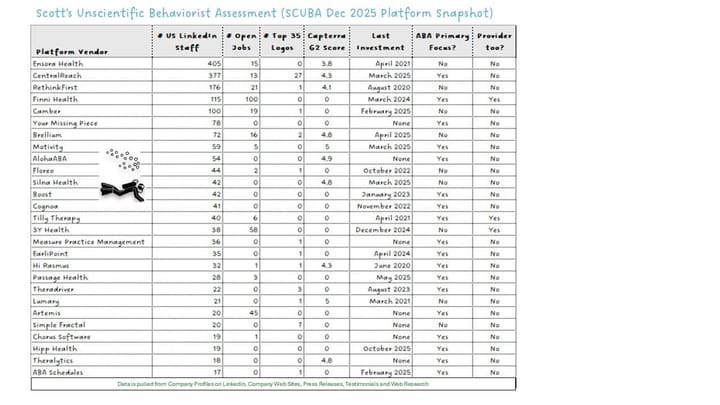

What the SCUBA Data Shows

Each month, I track the top 130 ABA providers through my SCUBA framework—an intentionally unscientific but consistently useful lens on hiring patterns, platform moves, and strategic growth.

What I’ve seen so far is that the largest providers continue to outpace mid-sized and smaller operators in terms of growth.

Organizations like Action Behavior Centers and The Stepping Stones Group aren’t just maintaining size—they’re accelerating. And they’re doing it by investing in operational maturity: enterprise data visibility, internal analytics, and real-time decision-making.

That kind of growth isn't guaranteed by simply being big. It comes from seeing one's business clearly—and acting on it quickly.

And being able to separate the table stakes (that can be outsourced) from the capabilities that drive true competitive advantage (and must be mastered) in order to provide a better experience for all stakeholders.

The Franchise Analogy (Revisited)

Many of these new clinician-first platforms resemble franchise models in other sectors:

- Shared infrastructure

- Local autonomy

- Margin-sharing for support and scale

In ABA, the term “McDonald’s of therapy” has historically been used to criticize large-scale, rigid clinical delivery.

But now, the same structure is being reimagined from the bottom up: decentralized branding, flexible caseloads, and a platform-as-a-service approach to operations.

That’s not inherently bad. In fact, it could be an elegant solution for many clinicians—if the infrastructure is secure, transparent, and aligned with care goals.

From Elemy to Tilly: A Strategic Pivot

The story of Elemy offers a useful case study. Once a heavily funded provider aiming to build a tech-first national autism network, the company eventually pivoted away from direct service delivery.

Now, through its spinout Tilly Health, it’s supporting clinician-led practices. From top-down blitzscaling to bottom-up enablement in just a few years.

Whether that reflects changing market conditions, lessons learned, or investor recalibration—it shows that there’s no single right way to scale.

Visibility, Security, and Stakeholder Trust

One area I’ll be watching closely is operational transparency—especially when it comes to:

- Revenue cycle management (RCM)

- Stakeholder engagement (families, payors, auditors)

- Data and security infrastructure

If the platform handles core functions like claims, credentialing, and documentation, it also holds a significant portion of your business—and your brand—in its hands.

And when something breaks, clinicians need both insight and support.

As this new wave grows, I hope to see robust attention paid to:

- Audit trails

- Stakeholder communication

- Data ownership

- HIPAA-level security across every operational layer

A New Platform Landscape: Three Generations

We’re starting to see a clearer segmentation of ABA platforms:

- Legacy Platforms

- CentralReach, Rethink, Aloha, Ensora, Raven

- Built for scaled session-based care; deeply integrated but less flexible

- Modern, Tech-Forward Platforms

- Clinician-First Platforms

- Alpaca, Headstart, 3Y, Finni, Tilly

- Focused on enablement through infrastructure and services—less about customization, more about support

All three approaches are evolving. And it’s still early.

What’s the Addressable Market?

That’s the question that will define the next 5+ years.

Are we looking at a long-tail opportunity where thousands of BCBAs run their own lean practices with targeted support?

Or will these platforms eventually consolidate upward—rolling up small groups into regionally dominant networks?

Historically, ABA has struggled with standardization—especially when it comes to clinical outcomes. That makes scale hard, no matter how clean your tech stack is.

Still, the investment pattern tells a story:

- Billion-dollar bets continue to go to platforms like CentralReach

- Million-dollar bets are fueling this new wave of clinician-first infrastructure

Final Thought: ABA Culture Will Decide

I’ve been close to this space for 7 years now. One thing is clear: ABA is a clinician-driven field.

Whether these new platforms thrive will depend not just on ROI or tech—but on culture and care.

Do BCBAs want to build their own thing?

Do they trust centralized infrastructure partners?

Will they prioritize ownership—or simplicity?

Will these Provider delivery models scale faster than the overall ABA market?

And what will outsourced 'table stakes' vs insourced 'strategic differentiator' capabilities look like for growing Providers?

I don’t have the answer yet. But I’m paying close attention.

And if these models can responsibly scale access, autonomy, and outcomes—I’ll cheer them on all the way.

Click here to subscribe for more insights on ABA technology, operations, and strategy.