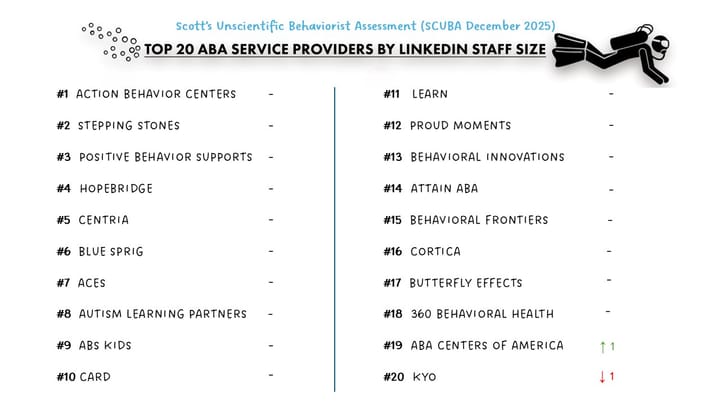

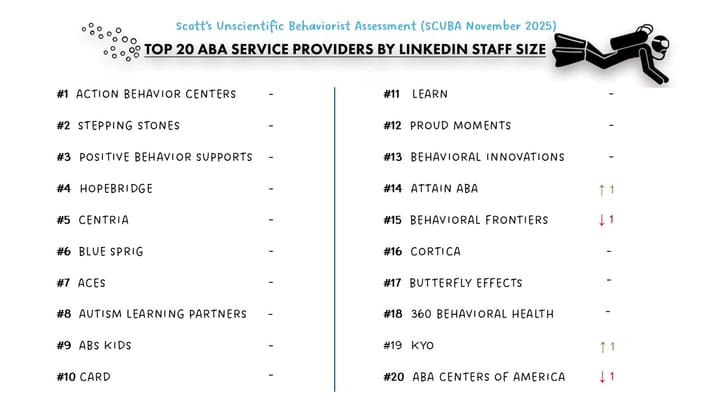

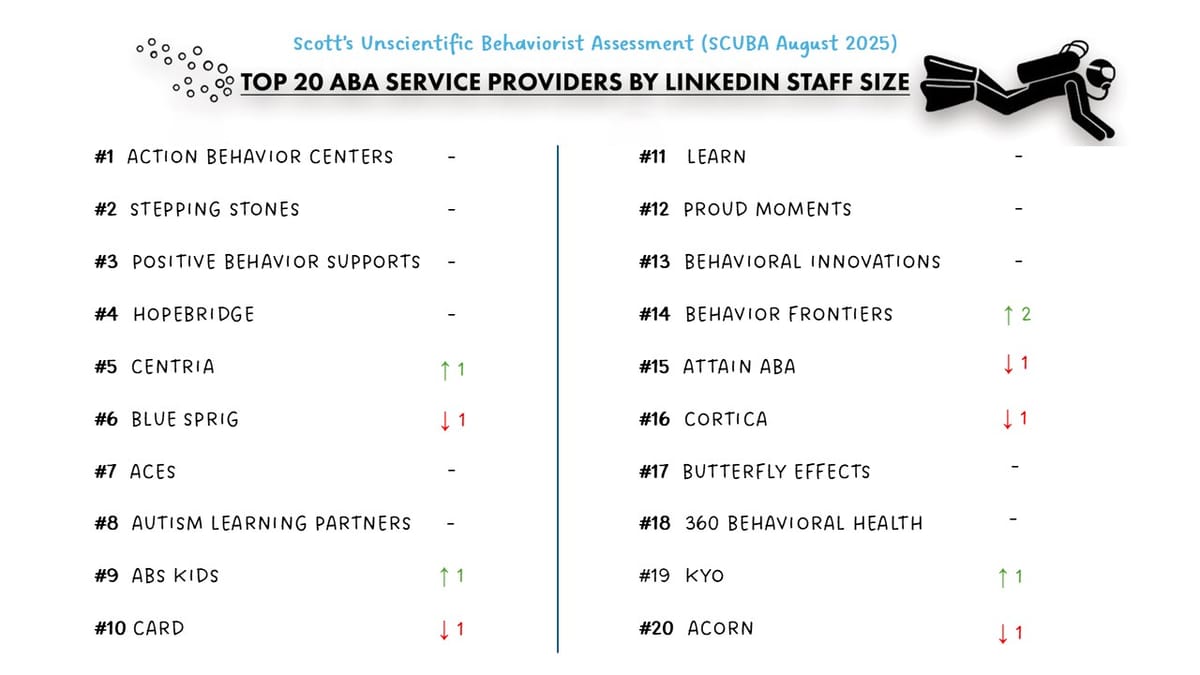

SCUBA: August 2025 ABA Provider Snapshot

Scott’s Completely Unscientific Behaviorist Assessment

⚠️ Methodology Reminder

This isn’t a census. LinkedIn misses many direct care staff, and headcounts can lag actual payroll. State counts come from provider websites, which may not always be current. But across 130+ providers, directional shifts highlight market momentum — which is often more useful than precision.

📈 August 2025 Snapshot – Slower Growth as Summer Ends

- LinkedIn-reported staff counts for the Top 20 grew just 1.3% — a slowdown from June’s surge and July’s steady climb.

- Job postings stayed flat, signaling that most summer hiring pushes are done and fall staffing is being absorbed into operations.

- This month's Operator Spotlight featured Top 20 ABA provider 360 Behavioral Health and their extensible ABA stack

- View Top 20 ABA provider profiles with commentary and # of states served here

🚀 Action & Stepping Stones Still Pulling Away

- Action Behavior Centers: +600 this summer. They remain the undisputed #1 — with over twice the headcount of the #3 provider.

- Stepping Stones: Consistent gains (+100 this summer), keeping them 50% larger than the #3 provider.

📊 Rankings Shuffle Slightly

- After months of near-stasis, we finally saw some small shifts within the Top 20 with the biggest gain by Behavior Frontiers moving up 2 positions.

- But the bigger story may be just outside: ABA Centers of America and Center for Social Dynamics are both pressing upward. If current trends continue, either could break into the Top 20 as early as September, now that schools are back in session.

🌱 Mid-Tier Momentum: The Fastest Movers

A few providers ranked outside of the top 20 once again outpaced the giants:

- SOAR: +7% MoM

- Yellow Bus ABA: +11% MoM

Their absolute scale is smaller, but their trajectories suggest strong organic growth — I'm looking forward to an Operator Spotlight on one of these soon.

💰 Efficiency Over Expansion

Between Medicaid funding uncertainty, rate pressures, and ongoing wage inflation, providers continue to favor operational productivity over headcount-driven growth. Expect more emphasis on credentialing, automation, and scheduling efficiency this fall.

📉 M&A at the Top: Still Missing

In a June post, I noted the near-total absence of large-scale ABA provider M&A — “A bet I want to lose.” That lack of movement has persisted thru Q2 and into August.

The exception has been Behavior Frontiers, which has distinguished itself as the sole Top 20 ABA provider involved in a transaction, and also one that has invested heavily in data, technology, and operations. For everyone else, the stasis is striking.

📬 If you’re scaling, investing, or just trying to understand where the ABA market is heading — let’s connect.