SCUBA Provider Metrics

Overview

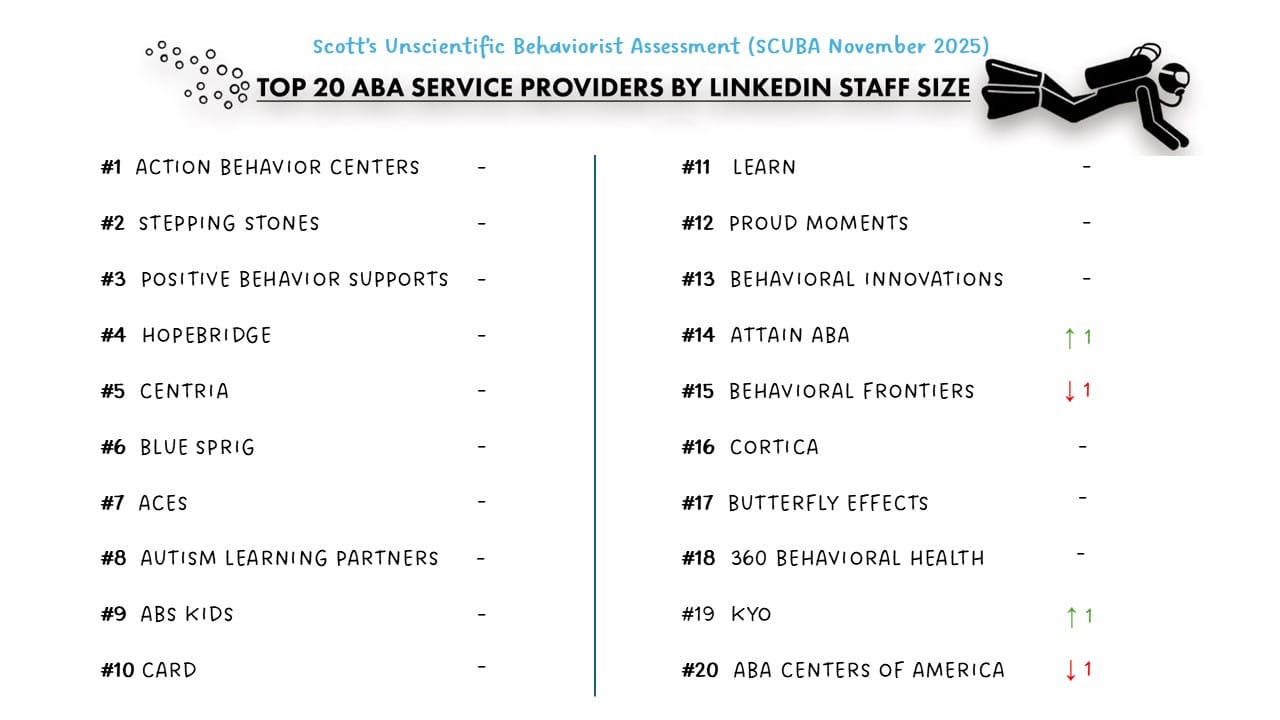

Welcome to SCUBA — Scott’s Completely Unscientific Behaviorist Assessment — where I track directional trends in ABA provider hiring, growth, and strategy using publicly available data.

The Provider SCUBA presents monthly updates based on LinkedIn staffing trends, job postings, and geographic presence. It surfaces directional insights into provider strategy, market consolidation, and operational pressure points.

⚠️ Important Note on Methodology

This data isn’t perfect. LinkedIn misses many direct care staff, and state counts come from provider websites, which aren't always current. But taken together, these signals help us understand momentum, not precision — and that’s often what matters most. Feedback and corrections are always welcome.

📌 Most Recent Update

👉 Read the latest Provider SCUBA →

The most recent report highlights current trends in hiring velocity, organizational stability, and shifts in state-level presence across large ABA providers.

🏥 Providers We Track

SCUBA reports focus on a stable group of large ABA providers that collectively shape the national landscape. These organizations represent a significant share of staffing and hiring activity:

- Action Behavior Centers

- Stepping Stones

- Positive Behavior Supports

- HopeBridge

- Blue Sprig

- Centria

- ACES

- Autism Learning Partners

- CARD

- ABS Kids

- Learn

- Proud Moments

- Behavioral Innovations

- Attain ABA

- Cortica

- Behavior Frontiers

- Butterfly Effects

- 360 Behavioral Health

- Acorn Health

- Center for Social Dynamics

- Kyo

- ABA Centers of America

- InBloom

- AnswersNow

- Yellow Bus ABA

- Akoya

📚 Previous Reports

Browse prior SCUBA posts for historical trends and context:

- October 2025 Provider SCUBA

- September 2025 Provider SCUBA

- August 2025 Provider SCUBA

- July 2025 Provider SCUBA

- June 2025 Provider SCUBA

- May 2025 Provider SCUBA

- April 2025 Provider SCUBA

- March 2025 Provider SCUBA

- February 2025 Provider SCUBA

- January 2025 Provider SCUBA

- December 2024 Provider SCUBA

📬 Stay Informed

Want custom benchmarks or deeper insight into platform alignment, market segmentation, or provider strategy?

Reach out anytime. I'm always open to collaboration and feedback.

👉 Subscribe to the ABA Mission Newsletter for monthly insights into ABA strategy, platform dynamics, and provider trends.